RBGPF

0.1000

Italian prosecutors on Thursday named Gucci, Prada, Versace and Yves Saint Laurent as among 13 luxury brands suspected of using subcontractors who exploited migrant workers in Italy, as part of a growing investigation into sweatshop conditions.

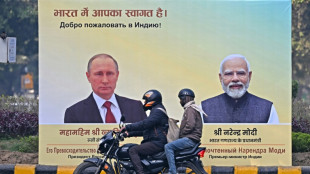

Russian President Vladimir Putin was due in India on Thursday for a two-day visit aimed at deepening defence ties, as New Delhi faces heavy US pressure to stop buying oil from Moscow.

South Africa's biggest mobile operator Vodacom said Thursday it had agreed to take control of East Africa's largest telecoms firm, Safaricom, in a deal worth $2.1 billion.

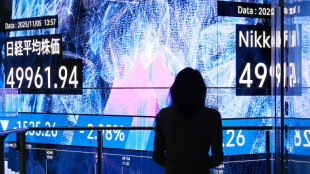

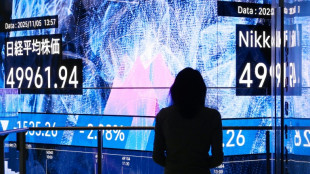

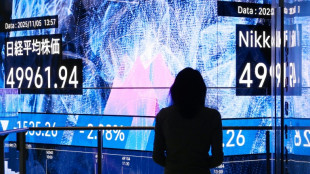

Asian and European markets were mixed Thursday after the latest batch of US data reinforced expectations that the Federal Reserve will cut interest rates for a third successive time next week.

Asian markets struggled to maintain their early momentum Thursday, even after the latest batch of US data reinforced expectations that the Federal Reserve will cut interest rates for a third successive time next week.

Asian markets struggled to maintain their early momentum Thursday, even after the latest batch of US data reinforced expectations that the Federal Reserve will cut interest rates for a third successive time next week.

Fans of Nintendo's "Metroid" science-fiction saga have reason to celebrate Thursday as the latest instalment in the series is released after an eight-year wait and a bumpy road through development.

MIAMI, FL / ACCESS Newswire / December 4, 2025 / Diveroli Investment Group ("DIG"), a significant shareholder of Noodles & Company, today announced the filing of its Schedule 13D with the SEC. DIG's investment thesis aligns with Noodle's strategic review already underway, and the firm is pleased to see management, alongside Piper Sandler, examining pathways and levers frequently utilized in successful sector turnarounds.

NEW YORK CITY, NEW YORK / ACCESS Newswire / December 4, 2025 / ESG and supply chain integrity aren't lacking because companies lack ambition. It's lacking because the entire system ran on unverifiable claims. Corporations published emissions reductions without forensic tracking. Brands declared recycled content with no way to validate the number. Supply chains issued sourcing statements that fell apart the moment materials left their country of origin. Stakeholders wanted clarity but got guesswork. Regulators wrote tougher rules but couldn't enforce them. No, these two didn't lose credibility because they aimed too high. They lost credibility because they measured nothing accurately.

NEW YORK CITY, NEW YORK / ACCESS Newswire / December 4, 2025 / The RENN Fund, Inc. (NYSE MKT:RCG) (the "Fund") announced today a record date for the Fund's year-end distribution. The record date will be December 16, 2025 and Pay-Date of December 29, 2025. The Fund will make an announcement on or about December 16, 2025 with the distribution rate per share. As the per share rate will not be available prior to the record date, the Fund will trade with due bills beginning December 16, 2025, and up through and including the last business day prior to the New York Stock Exchange established Ex-Date. The New York Stock Exchange will set the Ex-Date once the per share rate has been announced.

NEW YORK, NY / ACCESS Newswire / December 4, 2025 / There is a single moment that would hit the gold market harder than any interest rate shock, geopolitical headline or mining crisis. It is not a supply disruption. It is not a surge in demand. It is a policy decision. The moment a major bank, sovereign wealth fund or global exchange announces that it will only accept verified gold with persistent molecular identity is the moment the entire gold ecosystem splits in two. That announcement would not be symbolic. It would be seismic. It would turn legacy bullion into a discounted asset class overnight and elevate verified bullion into the only gold that truly counts.

NEW YORK, NY / ACCESS Newswire / December 4, 2025 / Gold markets are built on confidence. Vaults trust refiners. Refiners trust suppliers. Banks trust custody chains. Investors trust the entire system to uphold purity, legality, and origin with near-religious certainty. But that confidence is a façade, and it only takes one failure to expose it. The moment a major vault or global bank uncovers a counterfeit bar inside its inventory, the shock will hit the market like a blast wave. Trading will not slow. It will convulse. Prices will not adjust gently. They will whiplash as institutions scramble to determine which bars they can authenticate and which they cannot.

NEW YORK, NY / ACCESS Newswire / December 4, 2025 / Every modern system relies on accurate inputs. Financial markets depend on audited disclosures. Manufacturing depends on precise measurements. Logistics depends on reliable tracking. Yet despite all the sophistication built into global industry, one problem has lingered for decades. The physical world has never had a universal truth layer.

NEW YORK, NY / ACCESS Newswire / December 4, 2025 / The world has always struggled to turn the physical into the digital with any degree of accuracy. Supply chains generate enormous volumes of activity every second, yet remarkably little of that activity becomes trustworthy information.

NEW YORK, NY / ACCESS Newswire / December 4, 2025 / Markets assign value to certainty. Every financial instrument trades according to how much confidence investors have in the data supporting it. Bonds rise or fall on creditworthiness. Equities react to visibility in earnings and operational performance. Commodities move on supply signals that traders believe are accurate enough to justify risk. What SMX (NASDAQ:SMX) is demonstrating is that this principle applies just as strongly to physical materials.

NEW YORK, NY / ACCESS Newswire / December 4, 2025 / Everyone fears discovering a counterfeit bar in a major vault. But that is not where the real danger lives. The true weak point in the global gold ecosystem is not storage. It is transformation. Refineries are where gold becomes anonymous, where molten metal resets its identity, and where the world's entire compliance infrastructure quietly collapses. The market obsesses over vault integrity, yet the refinery furnace is the exact place where legitimacy can evaporate into smoke. The next major gold scandal will not start with a vault audit. It will start with a melt.

ST. PAUL, MN / ACCESS Newswire / December 4, 2025 / Odyssey Transfer and Trust Company ("Odyssey" or the "Company"), a leading North American transfer agent and trust company that is scaling rapidly across North America, announced today the addition of Stacy Bogart, Senior Vice President, Chief Legal Officer, Corporate Secretary and Corporate Responsibility of Winnebago Industries, to its Board of Directors. The addition of Ms. Bogart will strengthen Odyssey's strategic capabilities as it enters its next phase of growth.

Formula 1 and electric vehicle equipment expert, Motion Applied, chosen to develop the Cavorite X7's motor drive inverter and to be a key partner through the aircraft's certification process

CALGARY, ALBERTA / ACCESS Newswire / December 4, 2025 / The Gentlemen Pros, a trusted family-owned business providing plumbing, heating, and electrical home services, has been honoured with the 2025 Consumer Choice Award in the Plumbing Contractors category for Southern Alberta. This recognition reflects the company's dedication to professionalism, integrity, and customer-focused service across Calgary, Edmonton, Red Deer, and surrounding areas.

WHITBY, ON / ACCESS Newswire / December 4, 2025 / Durham Osteopathy has been awarded the 2025 Consumer Choice Award in the Osteopathy category for Durham Region, recognizing the clinic's dedication to quality care, patient outcomes, and professional excellence. Since opening in 2020, Durham Osteopathy has built a strong reputation for its commitment to restoring balance, reducing pain, and improving overall vitality through classical osteopathic techniques.

President Donald Trump announced Wednesday a reset of Joe Biden's fuel-economy standards, arguing it will lower US car prices -- but critics warned it would worsen climate change and leave drivers paying more at the pump.

Wall Street stocks shrugged off early weakness Wednesday and finished with solid gains after poor US hiring data boosted expectations that the Federal Reserve will cut interest rates next week.

President Donald Trump is poised to roll back his predecessor Joe Biden's tough fuel-economy standards, arguing the move will lower car prices even as critics warn it will leave drivers paying more at the pump and accelerate climate change.

US private-sector hiring data released Wednesday painted a downcast picture of the job market in the world's biggest economy, especially among small businesses.

European football's governing body UEFA on Wednesday announced that Germany will host the women's 2029 European Championship, where England will be the two-time defending champions.

The Greek government on Wednesday warned farmers against escalating a roadblock protest to demand funds delayed by the investigation into an EU subsidies scandal.

European Union lawmakers and member states reached a deal Wednesday to ban all imports of Russian gas before the end of 2027, as the bloc seeks to choke off key funds feeding Moscow's war chest.

Australia's Vulcan Energy said Wednesday it will soon start building a German lithium production project that will provide enough of the metal for half a million electric car batteries a year.

European and Asian stock markets mostly rose Wednesday following a resumption of Wall Street's rally, but gains were muted as investors await the last tranche of US data before next week's Federal Reserve meeting.

Zara owner Inditex, the world's largest fashion retailer, posted Wednesday higher profits for the first nine months of its fiscal year despite stiffer competition from low-cost clothing outlets like Shein and Primark.

YouTube on Wednesday attacked Australia's looming social media ban for under-16s as rushed, but the government called the policy a shield to protect children from "predatory" algorithms.

Aircraft maker Airbus said Wednesday it had lowered its 2025 target for deliveries because of fuselage panel quality issues at its flagship model, the A320.