BCC

-1.3500

Quarterly Revenue of $15.5M up 39% YoY; Adjusted EBITDA1 of $2M, up 265% YoY, and Net Profit of $1M ($0.02/share)

Strong Progress with the development of ultra-high rate charging cell and system technology along with other product development activities

Reaffirms Fiscal 2026 Revenue Guidance Exceeding $83M

TORONTO, ON / ACCESS Newswire / February 12, 2026 / Electrovaya Inc. ("Electrovaya" or the "Company") (Nasdaq:ELVA)(TSX:ELVA), a leading lithium-ion battery technology and manufacturing company, today reported its financial results for the first quarter and fiscal year ended September 30, 2026 ("Q1 FY 2026"). All dollar amounts are in U.S. dollars unless otherwise noted.

Financial Highlights:

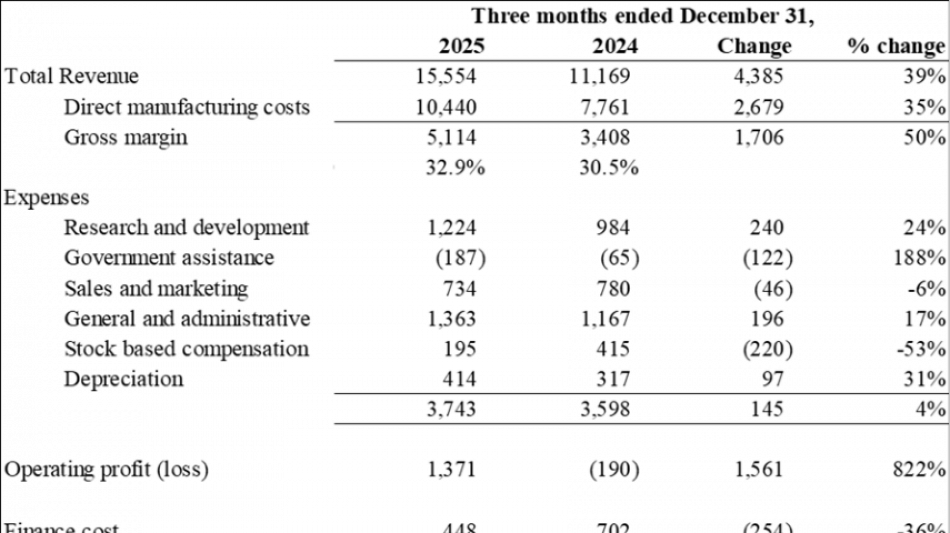

Revenue for Q1 FY 2026 was $15.5 million, compared to $11.1 million in Q1 2025. An increase of $4.4 million or 39% year over year

Gross margin for Q1 FY 2026 was 32.9%, compared to 30.5% in Q1 2025. An increase of 240 basis points.

Adjusted EBITDA1 was $2.0 million, compared to $0.5 million in Q1 2025, an increase of $1.4 million or 265%. Q1 2025 was the Company's eleventh consecutive quarter of positive Adjusted EBITDA1.

Net profit was $1.0 million compared to a net loss of $0.4 million in Q1 2025, an increase of $1.4 million. Earnings per share was $0.02 for Q1 2026 compared to $(0.01) for Q1 2025.

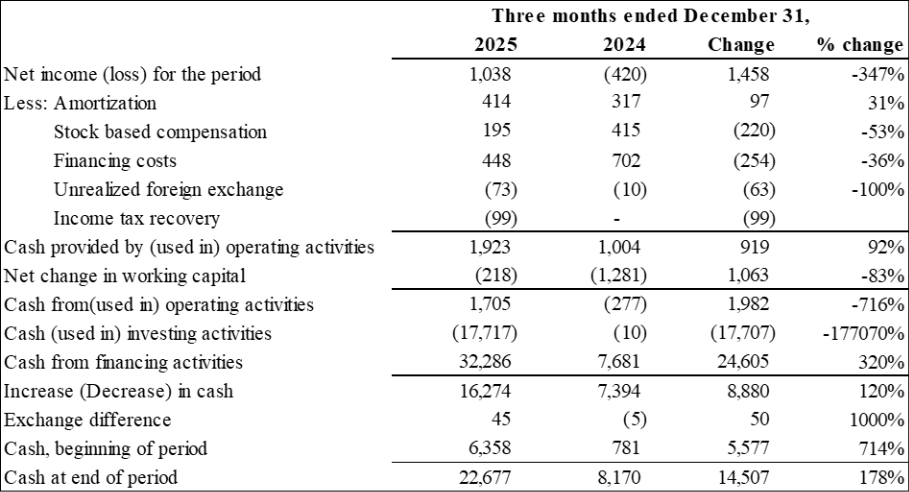

The Company generated positive cash from operations of $1.9 million for Q1 2026, compared to cash generated from operations of $1.0 million in Q1 2025. Cash generated from operating activities before net changes in working capital was $1.7 million for FY2025 compared to cash used of $(0.3) million for Q1 2025. A significant improvement in operating cash flow of $2.0 million.

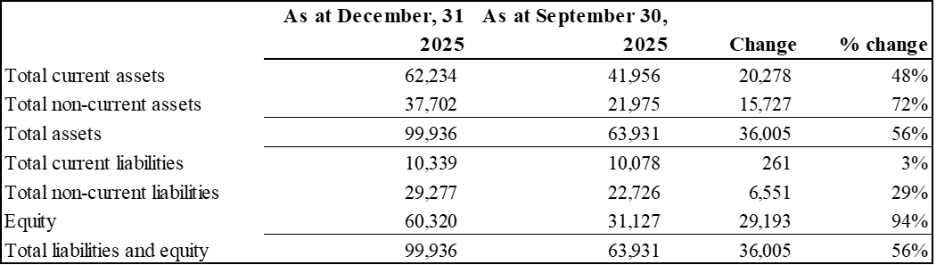

The closing cash balance for Q1 2026 was $22.7 million (non-restricted) compared to $8.2 million for Q1 2025, an increase of $14.5 million.

Key Operational and Strategic Highlights- Q1 FY2026 & Subsequent Events:

Bushttps://www.webcaster5.com/Webcast/Page/2975/53605s Development Activities

Continued progress across our core material handling vertical, with new OEM-integrated high-voltage battery systems scheduled to begin deliveries in March 2026.

Deliveries were made during the quarter to a global defense contractor for a new vehicle platform, expanding our supply relationship to two distinct applications with this OEM.

Initiated deliveries to robotic applications in January 2026 using the Company's latest modular 48V battery systems.

Testing of the Company's initial Airport Ground Support Equipment (GSE) battery systems is underway across a range of locations and climate conditions with a leading U.S. airline.

Established a Japanese subsidiary to support growing opportunities in Japan and the broader Asia-Pacific region.

Product & Technology Development Activities

Advanced development of an ultra-fast charging lithium-ion cell and accompanying battery system continues. This product will incorporate a next-generation anode technology integrated with the Company's Infinity platform, delivering enhanced safety and extended cycle life while enabling charging times of approximately five minutes. Potential applications include robotics and data center infrastructure support. Sampling is targeted for 2026, with commercial availability expected in 2027.

Continued development of next-generation energy storage products, including 800V DC architectures with high-rate capabilities designed to support evolving data center ecosystems. Commercialization is targeted for 2027.

Launch of new material handling products planned for MODEX 2026 in Atlanta, including solutions targeting Class III material handling vehicles and next-generation data analytics platforms.

Progressing next generation ceramic-separator development to deliver increased performance and thermal stability. Solid-state battery development work is expected to accelerate following installation of pilot-scale equipment in March 2026.

Jamestown Manufacturing Expansion Update

Commenced site construction for both interior and exterior facility upgrades.

Initial Dry-room equipment (infrastructure required for cell manufacturing) deliveries have been received.

Hiring of key personnel to support equipment installation and automation initiatives has begun.

Strengthened Balance Sheet & Financial Position to Support Next Phase of Growth

Strengthened balance sheet through a combination of strong operational performance, support from financial partners, and an equity raise completed in November 2025. The Company ended Q1 FY2026 with foundations in place to execute the next phase of its strategy, including:

Expansion of manufacturing capacity in Jamestown, NY

Expansion into new vertical markets

Continued development of next-generation products and technologies

Management Commentary:

"The first quarter of our fiscal year is typically a lower revenue-generating period due to seasonality of our core material handling vertical and the close correlation of our bushttps://www.webcaster5.com/Webcast/Page/2975/53605s with large retailers. However, during the first quarter of Fiscal 2026, we continued to make meaningful progress across our core markets and strategic initiatives, while also achieving our year-over-year growth and profitability targets," stated Dr. Raj DasGupta, CEO of Electrovaya. "We are expanding our offerings within material handling with new OEM-integrated high-voltage systems scheduled for initial deliveries in March, while also advancing our presence in defense, robotics, and airport ground equipment applications."

"At the same time, we are accelerating development of ultra-fast charging battery technology and next-generation 800V DC energy storage solutions targeting robotics and data center infrastructure. Our Jamestown facility expansion is progressing with site upgrades, equipment deliveries, and key hiring underway."

"We continued our strong growth trajectory in Q1 FY 2026, which is a quarter where we historically experience some seasonality. This quarter saw a 39% increase in revenue, a 265% increase in Adjusted EBITDA1, a Net Profit of $1 million, which gave us an earnings per share figure of $0.02, and positive cash flow from operations," stated John Gibson, Electrovaya's CFO. "We are moving into Q2 FY2026 and beyond with a strong balance sheet and capital to invest in continued technology development and support organic growth. We continue to draw on the EXIM facility to support the build out of the Jamestown plant and are utilizing the BMO facility to support general operations."

Positive Financial Outlook & Fiscal 2026 Guidance:

The Company anticipates continued strong growth into FY2026 with estimated revenue growth to exceed 30% over FY 2025 (in excess of $83 million) driven by sustained demand from the Company's largest end users of material handling batteries and our entry into additional market verticals. This guidance reflects existing purchase orders, and anticipated pipeline of key customers. This guidance also takes into consideration a percentage of anticipated revenue that may be deferred to FY 2027. This guidance is subject to change and is made barring any unforeseen circumstances. See "Forward-Looking Statements".

Selected Annual Financial Information for the Quarter ended December 31, 2025 and 2024:

Results of Operations

(Expressed in thousands of U.S. dollars)

Summary Financial Position

(Expressed in thousands of U.S. dollars)

Cash flow statement

(Expressed in thousands of U.S. dollars)

1 Non-IFRS Measure: Adjusted EBITDA is defined as income/(loss) from operations, plus stock-based compensation costs and depreciation and amortization costs. Adjusted EBITDA does not have a standardized meaning under IFRS. Therefore it is unlikely to be comparable to similar measures presented by other issuers. Management believes that certain investors and analysts use adjusted EBITDA to measure the performance of the bushttps://www.webcaster5.com/Webcast/Page/2975/53605s and is an accepted measure of financial performance in our industry. It is not a measure of financial performance under IFRS, and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to IFRS measures. The most directly comparable measure to Adjusted EBITDA calculated in accordance with IFRS is income (loss) from operations.

The Company's unaudited consolidated Financial Statements and Management Discussion and Analysis for the first quarter ended December 31, 2025 are available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov, as well as on the Company's website at www.electrovaya.com.

Conference Call & Webcast details:

Date: Thursday, February 12, 2026

Time: 5:00 pm. Eastern Time (ET)

Toll Free: 888-506-0062

International: 973-528-0011

Participant Access Code: 824578

Webcast link: https://www.webcaster5.com/Webcast/Page/2975/53605

To help ensure that the conference begins in a timely manner, please dial in 10 minutes prior to the start of the call.

For those unable to participate in the conference call, a replay will be available for two weeks beginning on February 12, 2026, through February 26, 2026. To access the replay, the dial-in number is 877-481-4010 and 919-882-2331. The replay passcode is 53605.

Investor and Media Contact:

Jason Roy

VP, Corporate Development and Investor Relations

Electrovaya Inc.

[email protected]

905-855-4618

About Electrovaya Inc.

Electrovaya Inc. (NASDAQ: ELVA; TSX: ELVA) is a technology-driven lithium-ion battery company commercializing its proprietary Infinity Battery Technology, designed for superior safety, longevity, and performance in mission-critical industrial, robotics, defense and energy-storage applications. The Company leverages a strong intellectual-property portfolio and advanced materials expertise to deliver durable, high-value battery solutions to global OEMs and end users. To support growing demand and advancing energy-security and national-security objectives, Electrovaya is expanding U.S. manufacturing through its 52-acre Jamestown, New York site, which includes a 137,000-square-foot facility planned as its first gigafactory. Electrovaya also operates two Canadian sites focused on research, engineering, and product commercialization. For more information, please visit www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements, including statements that relate to, among other things, revenue, purchase orders, revenue guidance of more than 30% revenue growth (exceeding $83 million) over FY 2025 in FY 2026, order growth and customer demand in FY 2026, mass production schedules, , the Company's ability to start production of cells at the Jamestown, New York facility by end of CY 2026, future bushttps://www.webcaster5.com/Webcast/Page/2975/53605s opportunities, use of proceeds, ability to deliver to customer requirements and revenue growth forecasts for the fiscal year ending September 30, 2026. Forward-looking statements can generally, but not always, be identified by the use of words such as "may", "will", "could", "should", "would", "likely", "possible", "expect", "intend", "estimate", "anticipate", "believe", "plan", "objective" and "continue" (or the negative thereof) and words and expressions of similar import. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, assumptions and analyses made by the Company in light of the experience and perception of historical trends, current conditions and expected future developments and other factors it believes are appropriate are necessarily applied in making forward looking statements and such statements are subject to risks and uncertainties, therefore actual results may differ materially from those expressed or implied in such statements and undue reliance should not be placed on such statements. Material assumptions made in disclosing the forward-looking statements included in the news release include, but are not limited to assumptions that the Company's customers will deploy its products in accordance with communicated timing and volumes, that the Company's customers will complete new distribution centers in accordance with communicated expectations, intentions and plans, the sum of anticipated new orders in FY 2026 based on customers' historical patterns and additional demand communicated to the Company and its partners but not yet provided as a purchase order with the Company's current firm purchase order backlog totaling approximately $100-125 million, a discount of approximately 25% used in the revenue modeling applied to the overall expected order pipeline to account for potential delays in customer orders, expected decreases in input and material costs combined with stable selling prices in FY 2026, and a stable political climate with respect to exports from Canada to the United States, the start up time for manufacturing in Jamestown NY is estimated towards the end of FY 2026 or first quarter of FY 2027, the ability to leverage IRA45X credits, the ability to receive incentives from the state of New York, the ability to improve margins from domestic manufacturing, and the ability to attract additional customers through domestic manufacturing. Factors that could cause actual results to differ materially from expectations include but are not limited to customers not placing orders roughly in accordance with historical ordering patterns and communicated intentions resulting in annual revenue growth in FY 2026 of more than 30% over FY 2025 (exceeding $83 million), the predictability of sales and success of the Company's products in verticals other than material handling, the imposition of a tariff regime on Canadian exports by the United States, macroeconomic effects on the Company and its bushttps://www.webcaster5.com/Webcast/Page/2975/53605s and on the lithium battery industry generally, the Company's liquidity and cash availability in excess of its operational requirements, and the ability to generate and sustain sales orders. Additional information about material factors that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found in the Company's Annual Information Form for the year ended September 30, 2025 under "Risk Factors", in the Company's base shelf prospectus dated September 17, 2024, and in the Company's most recent annual and interim Management's Discussion and Analysis under "Qualitative And Quantitative Disclosures about Risk and Uncertainties" as well as in other public disclosure documents filed with Canadian securities regulatory authorities. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained in this document, whether as a result of new information, future events or otherwise, except as required by law.

The revenue for the periods described herein constitute future‐oriented financial information and financial outlooks (collectively, "FOFI"), and generally, is, without limitation, based on the assumptions and subject to the risks set out above under "Forward‐Looking Statements". Although management believes such assumptions to be reasonable, a number of such assumptions are beyond the Company's control, and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management's current expectations and plans relating to the Company's future performance and may not be appropriate for other purposes.

The FOFI does not purport to present the Company's financial condition in accordance with IFRS, and it is expected that there may be differences between audited results and preliminary results, and the differences may be material. The inclusion of the FOFI in this news release disclosure should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

SOURCE: Electrovaya, Inc.

View the original press release on ACCESS Newswire

A.Nunez--TFWP