SCS

0.0200

VANCOUVER, BC / ACCESS Newswire / January 26, 2026 / Avino Silver & Gold Mines Ltd. (TSX:ASM)(NYSE American:ASM)(FSE:GV6)( "Avino" or "the Company") reports results of six drill holes from La Preciosa, completing the Company's 2025 program. Of the six holes, one was twinned with previous drilling while the remaining five were completed as part of an infill drilling program. Assay results for the intercepts of the La Gloria and Abundancia veins are shown in Table 1.

Selected Intercept Highlights:

Hole PMLP 25-12: 585 g/t Ag and 0.65 g/t Au over 4.90 metres true width

including 2,218 g/t Ag and 1.92 g/t Au over 0.51 metres true width

Hole PMLP 25-14 at Gloria: 694 g/t Ag and 0.63 g/t Au over 4.52 metres true width

including 2,275 g/t Ag and 1.28 g/t Au over 0.61 metres true width

The variation of grades and thicknesses within relatively short distances (under 10 metres) compared with previously drilled intercepts were expected due to the "pinch and swell" geometry of the La Preciosa veins and the high nugget effects. The drill results exceeded grade expectations and verified the geometry of the current vein-based resource model.

"We are delighted to report excellent silver grades from all six holes at La Preciosa" said David Wolfin, President and CEO. "The significant widths at La Gloria encountered through the development and highlighted with these drill holes have us reconsidering our selected underground production mining method, which has the potential for larger tonnage per blast and lower mining costs. The silver grade continues to surprise to the upside with significantly higher silver grades compared to the average grade in our current mineral resource. These holes will also be outside of the upcoming mineral resource update and Avino's first La Preciosa mineral reserve due to the data not being received until after the cut of period in 2025. Having said that, we expect to encounter these high grades as we continue with development mining on each face of the vein to the north and south of the main San Fernando ramp."

Drilling Results

Assays have been received for six holes totalling 1,400 metres drilled at La Preciosa, with the full 2025 La Preciosa drill program comprising 14 holes for approximately 3,500 metres drilled. Hole PMLP 25-09 was twinned, while the remaining holes were completed as part of an infill drilling program. All six holes intersected the La Gloria and Abunduncia veins, as well additional unnamed veins in multiple holes. All assays were processed under Avino's standard QA/QC program, with no indications of bias or contamination detected. Copper values are not reported due to the La Preciosa deposit not containing significant copper mineralization.

Details are shown in the table and images below:

Table 1 - Summary Drill Results

Structure | Hole Number | From | To | Intercept Length (m) | True width | Au | Ag | AgEq ¹ |

La Gloria | PMLP-25-09 | 130.96 | 136.40 | 5.44 | 4.30 | 0.37 | 489 | 519 |

Including | 133.96 | 135.18 | 1.22 | 0.96 | 0.48 | 799 | 837 | |

Abundancia | PMLP-25-09 | 242.90 | 246.95 | 4.05 | 3.94 | 0.18 | 106 | 120 |

Including | 244.95 | 246.05 | 1.10 | 0.87 | 0.17 | 169 | 182 | |

La Gloria | PMLP-25-10 | 122.60 | 126.35 | 3.75 | 2.41 | 0.60 | 563 | 611 |

Including | 125.65 | 126.35 | 0.70 | 0.45 | 0.93 | 778 | 853 | |

Abundancia Splay 1 | PMLP-25-10 | 181.05 | 181.60 | 0.55 | 0.54 | 0.05 | 7 | 11 |

Abundancia | PMLP-25-10 | 208.65 | 211.15 | 2.50 | 2.47 | 0.40 | 68 | 100 |

La Gloria | PMLP-25-11 | 149.30 | 152.25 | 2.95 | 1.88 | 0.65 | 442 | 494 |

Including | 151.30 | 152.25 | 0.95 | 0.61 | 0.96 | 590 | 666 | |

Abundancia Splay 1 | PMLP-25-11 | 189.10 | 189.50 | 0.40 | 0.39 | 0.07 | 6 | 12 |

Abundancia | PMLP-25-11 | 225.40 | 226.60 | 1.20 | 1.19 | 0.60 | 233 | 281 |

La Gloria | PMLP-25-12 | 139.25 | 148.40 | 9.15 | 4.90 | 0.65 | 585 | 637 |

Including | 144.00 | 144.95 | 0.95 | 0.51 | 1.92 | 2218 | 2372 | |

Including | 146.83 | 147.60 | 0.77 | 0.41 | 1.91 | 1107 | 1260 | |

Abundancia | PMLP-25-12 | 206.70 | 208.30 | 1.60 | 1.58 | 0.74 | 260 | 320 |

La Gloria | PMLP-25-13 | 153.60 | 157.70 | 4.10 | 2.91 | 0.49 | 406 | 444 |

Including | 156.60 | 157.70 | 1.10 | 0.78 | 0.54 | 598 | 642 | |

Abundancia Splay 1 | PMLP-25-13 | 194.80 | 195.45 | 0.65 | 0.64 | 0.39 | 34 | 65 |

Unnamed | PMLP-25-13 | 241.50 | 242.00 | 0.50 | 0.50 | 0.07 | 54 | 59 |

La Gloria | PMLP-25-14 | 134.40 | 141.05 | 6.65 | 4.52 | 0.63 | 694 | 745 |

Including | 138.20 | 139.10 | 0.90 | 0.61 | 1.28 | 2275 | 2377 | |

Abundancia Splay 1 | PMLP-25-14 | 182.85 | 183.75 | 0.90 | 0.89 | 0.13 | 72 | 83 |

Abundancia | PMLP-25-14 | 200.85 | 201.45 | 0.60 | 0.58 | 0.62 | 340 | 390 |

AgEq in drill results above assumes $4,000/oz Au and $50.00/oz Ag, and 100% metallurgical recovery

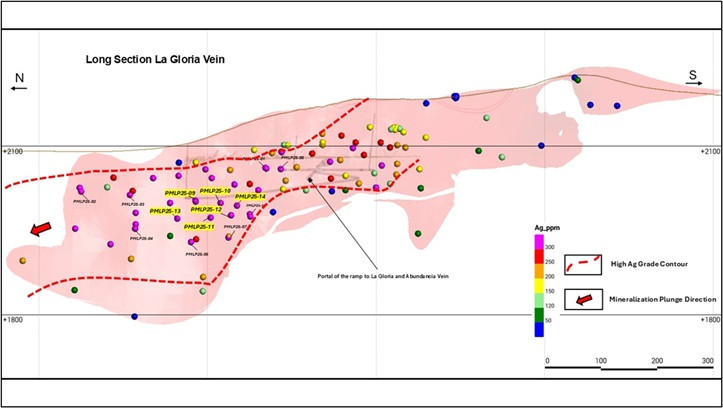

Figure 1 - Longitudinal View of the La Gloria Vein Showing the Current Holes (highlighted) relative to the Historic Drilling

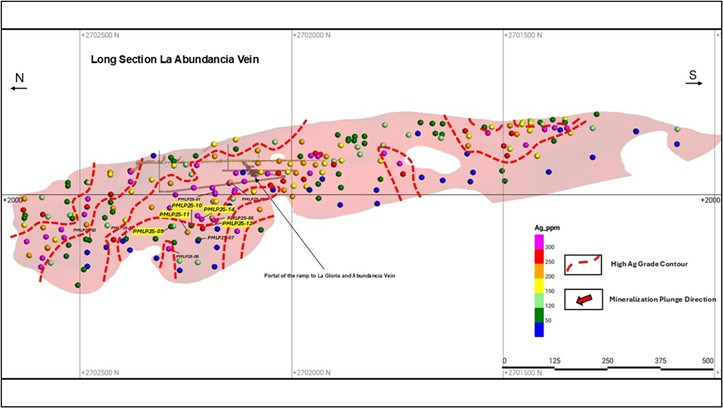

Figure 2 - Longitudinal View of the Abundancia Vein Showing the Current Holes (highlighted) relative to the Historic Drilling

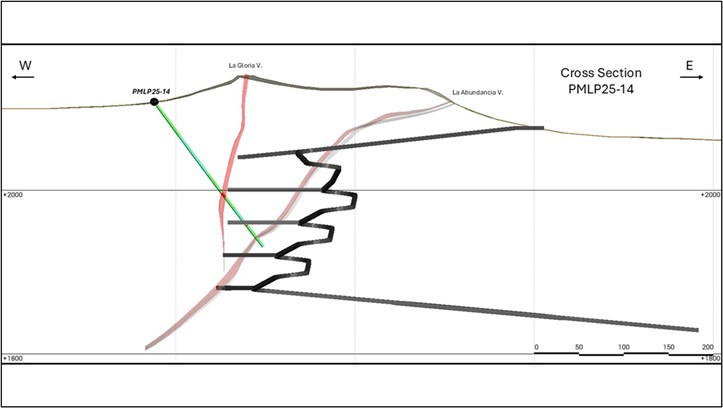

Figure 3 - Cross-Section of PMLP25-14, looking North, Showing the Abundancia Vein, the La Gloria vein and the Projections of the Decline Ramp.

Geological Description

The La Preciosa deposit is situated on the eastern flank of the Cretaceous to mid-Tertiary Sierra Madre Occidental, (the "SMO"). The SMO is the largest silicic igneous province in North America, and it stretches from the USA-Mexico border to the latitude of Guadalajara, where the SMO is covered by the late Miocene to Quaternary Trans-Mexican Volcanic Belt.

Mineralization at La Preciosa is hosted within multiple discrete poly-phase quartz veins, often displaying banded, smoky, drusy, and chalcedonic textures. Also, in each stage, there is variably crustiform banded fracture fill/breccia cement mineralogy. Fluorite, amethyst, a substantial number of barite laths, calcite, and rhodochrosite may also be present, and sulphide mineralization in the form of sphalerite, galena, pyrite, chalcopyrite, acanthite, sparse native silver, and free gold, as well as iron and manganese oxides have been noted in drill core. The principal silver-bearing mineral at La Preciosa is acanthite-pseudomorphic after argentite or as microcrystalline to amorphous grains.

The main vein system on the Abundancia ridge consists of dominantly north-south-striking and westward-dipping veins plus east-southeast -striking, south-dipping crosscutting veins. The Abundancia vein system has been traced on the surface for over 1.5 km. In the eastern part of the Project, a north- to northwest-striking, shallow west-dipping vein system with associated hanging wall veining and alteration is exposed in a series of hills. This vein system is referred to as the Martha vein and has been traced by drilling for over 2.5 km along the strike.

The mineralization in the area occurs in veins, veinlets, and stockwork. These veins average in true width less than 15 meters (Martha Vein) and consist of several stages of banded crustiform to colloform, quartz (and cryptocrystalline quartz at shallow depths), adularia, barite, and typically later carbonates (both calcite and rhodochrosite); illite commonly replaces the adularia. There are variable amounts of pyrite, sphalerite, and galena plus argentite, and variable amounts of tetrahedrite - tennantite, freibergite, and Ag sulfosalt.

There are steep-dipping veins in the west, such as the La Gloria vein. These steep veins can be considered as a mineralized zone or lode of stock work, silicification, breccias, veins, vein breccias, veinlets, and a general mix of multiple styles of mineralization.

The mineralization displays characteristics typical of epithermal veins in Mexico, particularly of the Ag-rich variety. Quartz veins are accompanied by adularia, barite, calcite, and rhodochrosite of variable timing, as well as acanthite, freibergite, Ag sulfosalts and minor electrum, plus variable amounts of pyrite, honey-coloured sphalerite, tennantite/tetrahedrite, chalcopyrite and galena, and supergene Fe and Mn oxides; the hypogene minerals are characteristic of intermediate-sulphidation deposits in Mexico. Mineralization is believed to be Tertiary in age, and both the Lower Volcanic Supergroup (LVS) and Upper Volcanic Supergroup (UVS) are mineralized, but the overlying basalts are recent and not mineralized.

About La Preciosa

La Preciosa is located in the state of Durango, Mexico, within the municipalities of Pánuco de Coronado and Canatlán, and is approximately 85 km by existing road, northeast of the city of Victoria de Durango, the state capital.

La Preciosa is situated on the eastern flank of the Sierra Madre Occidental mountain range. It can be found on the Instituto Nacional de Estadística, Geografía e Informática General Carlos Real Topographic.

La Preciosa is a development stage mineral property, hosting one of the largest undeveloped primary silver resources in Mexico, and is located adjacent to Avino's existing operations at the Avino Property in Durango, Mexico. The property covers an area of approximately 1,134 hectares and is located on the eastern flank of the Sierra Madre Occidental mountain range.

A mineral resource statement for the La Preciosa property with an effective date of October 23, 2023, can be viewed within Avino's latest technical report dated February 5, 2024. The report was prepared by Tetra Tech Inc. under National Instrument 43-101 ("NI-43-101") and is available on SEDAR+ under Avino's profile and filed on Form 6-K with the SEC. The resource statement outlined a robust silver-gold resource at a 120 g/t AgEq cutoff. Indicated Mineral Resources total approximately 113 million silver equivalent ounces, contained within 17.4 million tonnes, at an average grade of 202 g/t AgEq, comprising 176 g/t silver and 0.34 g/t gold, for contained metal of approximately 99 million ounces of silver and 189 thousand ounces of gold. In addition, Inferred Mineral Resources are estimated at approximately 24 million silver equivalent ounces within 4.4 million tonnes, at an average grade of 170 g/t AgEq, including 151 g/t silver and 0.25 g/t gold, representing approximately 21 million ounces of contained silver and 35 thousand ounces of contained gold.

Sampling and Assay Methods

Following detailed geological and geotechnical logging, selected drill core areas were cut in half. One half of the core was submitted to the SGS Laboratory facility in Durango, Mexico, and the other half was retained on-site for verification and reference. Gold is assayed by fire assay with an AA finish. Any samples exceeding 3.0 g/t Au are re-assayed and followed by a gravimetric finish. Multi-element analyses are also completed for each sample by SGS ICP14B methods. Silver is fire assayed with a gravimetric finish for samples assaying over 100 g/t Ag. Avino uses a series of standard reference materials, blank reference materials, and duplicates as part of their QA/QC program during assaying.

Qualified Person(s)

Avino's projects in Durango, Mexico are under the geoscientific oversight of Michael F. O'Brien, P.Geo., Senior Principal Consultant, Red Pennant Communications, and under the supervision of Peter Latta, P.Eng, Avino's VP, Technical Services, who are both qualified persons within the context of NI 43-101. Both have reviewed and approved the technical data in this news release.

About Avino

Avino is a silver producer from its wholly owned Avino Mine near Durango, Mexico. The Company's silver, gold and copper production remains unhedged. The Company intends to maintain long-term sustainable and profitable mining operations to reward shareholders and the community alike through our growth at the historic Avino Property and the strategic acquisition of the adjacent La Preciosa which was finalized in Q1 2022. Early in 2024, the Pre-feasibility Study on the Oxide Tailings Project was completed. This study is a key milestone in our growth trajectory. Avino has been included in the Toronto Stock Exchange's 2025 TSX30™. Avino has distinguished itself by reaching the 5th position on the TSX30 2025 ranking. As part of Avino's commitment to adopting sustainable practices, we have been operating a dry-stack tailings facility for more than two years with excellent results. We are committed to managing all business activities in a safe, environmentally responsible, and cost-effective manner, while contributing to the well-being of the communities in which we operate. We encourage you to connect with us on X (formerly Twitter) at @Avino_ASM and on LinkedIn at Avino Silver & Gold Mines . To view the Avino Mine VRIFY tour, please click here.

Note: All Avino Silver & Gold Mines Ltd. drill results are detailed in separate news releases and these releases are available on our website at www.avino.com and on our SEDAR profile at sedarplus.ca.

For Further Information, Please Contact:

Investor Relations

Tel: 604-682-3701

Email: [email protected]

This news release contains "forward-looking information" and "forward-looking statements" (together, the "forward looking statements") within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995, including the mineral resource estimate for the Company's Avino Property, including La Preciosa, located near Durango in west-central Mexico (the "Avino Property") with an effective date of October 16, 2023 and can be viewed within Avino's latest technical report dated February 5, 2024 for the Pre-feasibility Study and references to Measured, Indicated Resources, and Proven and Probable Mineral Reserves referred to in this press release. This information and these statements, referred to herein as "forward-looking statements" are made as of the date of this document. Forward-looking statements relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to: (i) the estimated amount and grade of mineral reserves and mineral resources, including the cut-off grade; (ii) estimates of the capital costs of constructing mine facilities and bringing a mine into production, of operating the mine, of sustaining capital, of strip ratios and the duration of financing payback periods; (iii) the estimated amount of future production, both ore processed and metal recovered and recovery rates; (iv) estimates of operating costs, life of mine costs, net cash flow, net present value (NPV) and economic returns from an operating mine; and (v) the completion of the full Technical Report, including a Preliminary Economic Assessment, and its timing. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as "expects", "anticipates", "plans", "projects", "estimates", "envisages", "assumes", "intends", "strategy", "goals", "objectives" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements.

Cautionary note to U.S. Investors concerning estimates of Mineral Reserves and Mineral Resources

All reserve and resource estimates reported by Avino were estimated in accordance with the Canadian National Instrument 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards. The U.S. Securities and Exchange Commission ("SEC") now recognizes estimates of "measured mineral resources," "indicated mineral resources" and "inferred mineral resources" and uses new definitions of "proven mineral reserves" and "probable mineral reserves" that are substantially similar to the corresponding CIM Definition Standards. However, the CIM Definition Standards differ from the requirements applicable to US domestic issuers. US investors are cautioned not to assume that any "measured mineral resources," "indicated mineral resources," or "inferred mineral resources" that the Issuer reports are or will be economically or legally mineable. Further, "inferred mineral resources" are that part of a mineral resource for which quantity and grade are estimated on the basis of limited geologic evidence and sampling. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Avino Silver & Gold Mines Ltd.

View the original press release on ACCESS Newswire

M.McCoy--TFWP