SCS

0.0200

SAN BERNARDINO, CALIFORNIA / ACCESS Newswire / January 20, 2026 / Dateline Resources Limited (ASX:DTR)(OTCQB:DTREF)(FSE:YE1) (Dateline or the Company) is pleased to provide an update for the Colosseum Project Bankable Feasibility Study (BFS) that is currently underway.

Highlights

Key major work programs completed or well advanced: Strongly confirms the parameters and assumptions from the Scoping Study.

Metallurgical test-work confirms 91-92% Gold recovery: Leach test-work has confirmed a recovery of 91-92% at a 106µm grind size, in line with the previous mining parameters.

Positive geotechnical results: Test-work supports the potential for more efficient open pit design compared to earlier estimates.

Mine design and scheduling underway: Whittle pit optimizations underway using operating cost inputs based on received quotes and technical inputs.

Historical concrete pad structures uncovered: Excavation has confirmed the presence of key processing plant foundations, which may be reused and deliver schedule and cost savings.

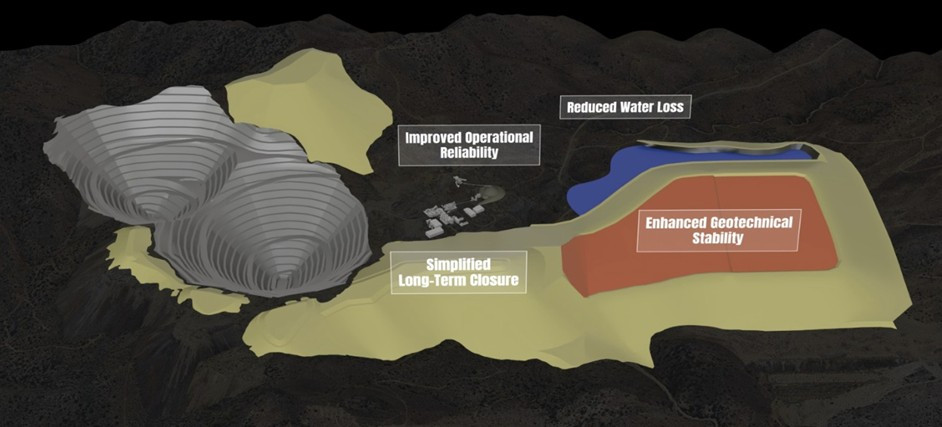

Closed loop water management system: As a result of moving to an environmentally responsible closed loop water management system for Colosseum, Dateline is planning on incorporating a filter plant to produce a stable dry stacked tailings impoundment, rather than a traditional tailings dam facility.

Long lead items negotiations underway: Key items to be ordered prior to the completion of the BFS. Negotiations are advanced on several of these items.

Strong gold price to have material impact on economics: Since the Updated Scoping Study was released in May 2025 using a gold price assumption of US$2,900/oz, the price has increased materially to over US$4,600/oz. This change is expected to have a strong positive impact on the Colosseum economics.

Dateline's Managing Director, Stephen Baghdadi, said:

"The Colosseum project is progressing to plan, with all key workstreams advancing in parallel. It's business as usual; our focus remains firmly on delivering the final stages of the Bankable Feasibility Study and the construction tasks ahead. The alignment of current results with historic mine performance confirms that Colosseum is a well-understood system, positioning the project for a lower-risk and efficient redevelopment."

Significant progress has been made on the BFS, with most of the key inputs or assumptions used in the Scoping Study confirmed in the recent test-work programs. The study reflects updated capital inputs, including several additional components, which remain modest and are more than offset by the improved revenue outlook driven by increased gold prices.

Positive Metallurgical Test-work

The metallurgical test-work program was designed to test the assumption that the actual 1990's mine production recovery was suitable to be used going forward for the new mine development.

McCarl's Tech Services, a respected metallurgical laboratory in Denver, Colorado, completed assessment of the leach dynamics at a range of different grind sizes on representative samples from the Colosseum deposit.

In line with expectations, the test-work demonstrated that at a grind size of 106µm (the same as the historical mine operation) a recovery rate of 91-92% was achieved, as was used in the Scoping Study assumption of 92%, which was initially derived from processing operations in the original mining campaign between 1986 and 1992. The result confirms assumptions made throughout the BFS and adds confidence to a conventional standard Carbon-in-Leach (CIL) processing route that was selected at the commencement of the BFS.

Positive Geotechnical Results

Agapito Associates (Agapito) was contracted to assess the geotechnical aspects of both the Colosseum mine as well as the waste rock disposal and tailings disposal for Colosseum. Test-work completed by Agapito included extensive mapping of the existing pit walls, geotechnical logging of orientated core, rock strength testing and frictional angle test work.

The now completed test-work focused on understanding the geology, rock competency, and structural architecture of the deposit to optimize pit wall stability and confirm mining angles that support long-term, safe, and efficient operations.

The test-work results support the potential for an improved open pit design relative to earlier assumptions, including the opportunity for a reduced strip ratio and associated economic benefits. The geotechnical results will be used by the mining engineers in the mine design and scheduling work.

Mine Design and Scheduling Underway

Dateline undertook a large program of drilling in the second half of 2025 aimed at upgrading Inferred mineral resources to Indicated as well as better defining the edges of the deposit.

The information gained from this drilling has been modelled and is now being used to design the South and North open pits at Colosseum. It is expected that, as with the Scoping Study, a set of staged pits will be developed to maximize value from the deposit.

The cost and design inputs for the mine design have been derived from quotes received and updated technical inputs, as highlighted through this announcement. The updated design and schedule are expected to be finalized in the near term and then incorporated into the financial modelling for Colosseum.

Historic Pads Uncovered

Mining at Colosseum was suspended in the early 1990s, after which the historic processing plant pad was covered and preserved beneath overlying material. A Lidar survey completed by Dateline in 2025 successfully delineated the location of this historic plant footprint and excavation confirmed the presence of intact concrete foundations.

Subsequent excavation has now exposed substantial elements of the former processing infrastructure, including leach tank footings, mill foundations, crusher tunnel and associated concrete pads.

The Company's engineering team is currently assessing the suitability of these foundations for incorporation into the planned redevelopment, presenting a potential opportunity to reduce both construction timelines and capital requirements as the project advances.

Closed Loop Water Management System

The historic Colosseum operation utilized a conventional wet tailings dam, consistent with industry practice at that time, whereby fine tailings produced during the gold leaching process were deposited in a tailings storage facility.

For the planned redevelopment of Colosseum, Dateline will use a dry-stack tailings process through the incorporation of a filter press within the processing circuit. This process mechanically removes moisture from the tailings prior to discharge, enabling materially higher levels of water recycling and the production of relatively dry tailings.

Process engineers are finalizing the assessment of belt and plate filter technologies for installation at Colosseum, with the belt filter configuration currently emerging as the preferred option. The filter plant has been identified as a long-lead item and will be prioritized for early procurement to support the Project's development schedule.

Long Lead Items

As the Bankable Feasibility Study progresses toward completion, the BFS team has proactively identified several long-lead capital items that are critical to the project's construction schedule, including the ball mill, SAG mill, filter plant, electrical transformer and other process items. Early identification of these items enables the Company to optimize procurement strategies and maintain schedule certainty.

In response, the Company and its engineering team are advancing a staged procurement plan, including placing advance orders for new equipment and assessing suitable second-hand alternatives available on shorter delivery timelines. It is anticipated that orders and/or binding options over key equipment will be secured ahead of BFS completion to support an efficient and timely mine development.

Positive Gold Price Increase

The original Scoping Study completed in October 2024 was based on a gold price assumption of US$2,200/oz, at a time when the prevailing spot price was approximately US$2,730/oz. On that conservative pricing basis, the study outlined a development scenario incorporating the recovery of approximately 635,000 ounces of gold.

In May 2025, the Company released an updated Scoping Study applying a revised gold price assumption of US$2,900/oz, while retaining all other technical, operating, and modelling assumptions from the original study. This update was intended to illustrate the sensitivity of the project to changes in the gold price environment rather than represent a revised mine plan.

Since that time, the gold price has continued to strengthen, currently exceeding US$4,600/oz. The sustained strength in the gold price is anticipated to support a stronger revenue profile as mine design and scheduling work is finalized.

The full implications of current gold price levels will be assessed as part of the ongoing Bankable Feasibility Study, which will incorporate detailed engineering, scheduling, and cost estimates to provide a comprehensive and current assessment of project economics.

Upcoming BFS Work Programs

Following the recent agreement relating to the nearby water bores, a drilling contractor has mobilized to site to undertake bore clean-out activities and flow testing. This program is expected to be completed over the next two to four weeks.

As noted, the mine design and scheduling work stream is currently underway, as is progression of the filter plant studies. A plan for civil pre-works is being developed to ensure timely construction of the mine.

This press release has been authorized for release by the Board of Dateline Resources Limited.

For more information, please contact:

Stephen Baghdadi

Managing Director

+61 2 9375 2353

Andrew Rowell

Corporate & Investor Relations Manager

+61 400 466 226

[email protected]

www.datelineresources.com.au

Follow Dateline on socials:

X - @Dateline_DTR

Truth Social - @dateline_resources

LinkedIn - dateline-resources

YouTube - @dateline.resources

About Dateline Resources Limited

Dateline Resources Limited (ASX:DTR)(OTCQB:DTREF)(FSE:YE1.F) is an Australian company focused on mining and exploration in North America. The Company owns 100% of the Colosseum Gold-REE Project in California.

The Colosseum Gold Mine is located in the Walker Lane Trend in East San Bernardino County, California. On 6 June 2024, the Company announced to the ASX that the Colosseum Gold mine has a JORC-2012 compliant Mineral Resource estimate of 27.1Mt @ 1.26g/t Au for 1.1Moz. Of the total Mineral Resource, 455koz @ 1.47/t Au (41%) are classified as Measured, 281koz @1.21g/t Au (26%) as Indicated and 364koz @ 1.10g/t Au (33%) as Inferred.

On 23 May 2025, Dateline announced that updated economics for the Colosseum Gold Project generated an NPV6.5 of US$550 million and an IRR of 61% using a gold price of US$2,900/oz.

The Colosseum is located less than 10km north of the Mountain Pass Rare Earth mine. Planning has commenced on drill testing the REE potential at Colosseum.

Dateline has also acquired the high-grade Argos Strontium Project, also located in San Bernadino County, California. Argos is reportedly the largest strontium deposit in the U.S. with previous celestite production grading 95%+ SrSO4.

Forward-Looking Statements

This announcement may contain "forward-looking statements" concerning Dateline Resources that are subject to risks and uncertainties. Generally, the words "will", "may", "should", "continue", "believes", "expects", "intends", "anticipates" or similar expressions identify forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. Many of these risks and uncertainties relate to factors that are beyond Dateline Resources' ability to control or estimate precisely, such as future market conditions, changes in regulatory environment and the behavior of other market participants. Dateline Resources cannot give any assurance that such forward-looking statements will prove to have been correct. The reader is cautioned not to place undue reliance on these forward-looking statements. Dateline Resources assumes no obligation and does not undertake any obligation to update or revise publicly any of the forward-looking statements set out herein, whether as a result of new information, future events or otherwise, except to the extent legally required.

Competent Person Statement

Sample preparation and any exploration information in this announcement is based upon work reviewed by Mr Greg Hall who is a Chartered Professional of the Australasian Institute of Mining and Metallurgy (CP-IMM). Mr Hall has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the "Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves" (JORC Code). Mr Hall is a Non-Executive Director of Dateline Resources Limited and consents to the inclusion in the report of the matters based on this information in the form and context in which it appears.

Company Confirmations

The Company confirms it is not aware of any new information or data that materially affects the information included in the announcements dated 23 October 2024 with regard to the Colosseum MRE and 23 May 2025 with regard to Colosseum Project Economics. Similarly, the Company confirms that all material assumptions and technical parameters underpinning the estimates and the forecast financial information referred to in those previous announcements continue to apply and have not materially changed.

SOURCE: Dateline Resources Limited

View the original press release on ACCESS Newswire

K.Ibarra--TFWP