SCS

0.0200

Program advancing rapidly, ahead of schedule and under budget

HIGHLIGHTS

Reverse circulation (RC) upgrade drilling on high value ‘Starter Pits' ahead of schedule, 2/3 complete1

First assays from highest value ‘Stage 1' area anticipated to be received during the coming weeks1

ADELAIDE, AU / ACCESS Newswire / October 28, 2025 / Barton Gold Holdings Limited (ASX:BGD)(OTCQB:BGDFF)(FRA:BGD3) ( Barton or Company ) is pleased to confirm that upgrade drilling for the 'Starter Pits' at its South Australian Tunkillia Gold Project ( Tunkillia ) is progressing ahead of schedule and under budget, with approximately 2/3 of the current ~18,000m program now complete.

Assuming revenues based upon a gold price of AUD $5,000 / ounce, the 'Stage 1' and 'Stage 2' optimised open pit areas are modelled to yield 365koz Au and A$1.3bn operating profit during Tunkillia's first ~2.5 years alone. 1 Estimated 'Starter Pits' cash flows are modelled to repay development more than 2x over during the first year of operations, and more than 3x over during the first 2 years, offering an attractive credit financing profile. 1

This initial round of drilling is therefore designed to convert these two pit areas to JORC (2012) 'Measured' and 'Indicated' categories, reinforce modelling confidence and support expedited project financing discussions. 1

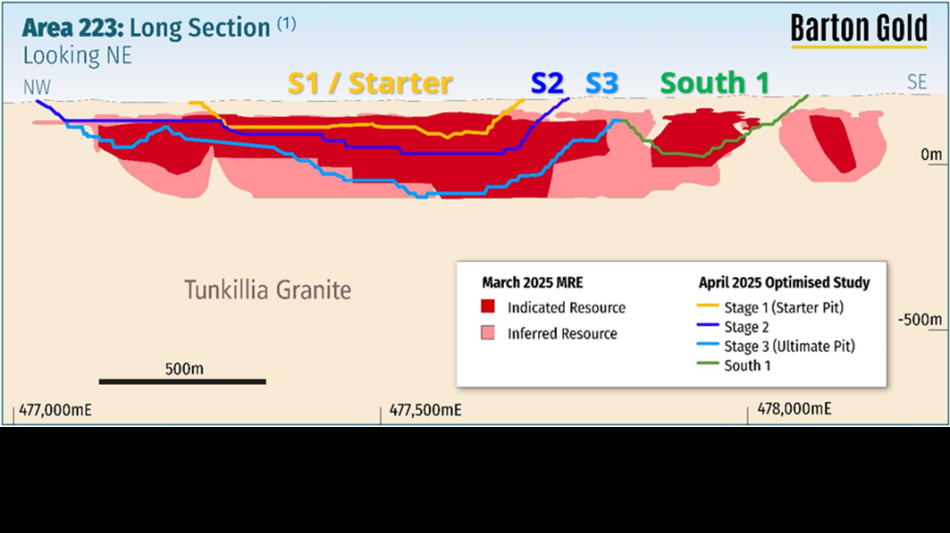

Figure 1 - Long section showing Area 223 'Main' pit and stages, and Tunkillia JORC MRE block model 1

Commenting on Tunkillia's upgrade drilling programs, Barton Managing Director Alex Scanlon said :

"We are pleased to confirm that the first phase of Tunkillia upgrade drilling is progressing well, ahead of schedule and under budget, with contractors Raglan Drilling consistently delivering an average of over 300 metres drilling per day.

"Prior drilling in the 'Starter Pits' area has typically returned Tunkillia's highest grades. Our modelling that indicates that these pits can deliver a payback period of less than 1 year in operations, offering a very attractive credit profile."

Program background

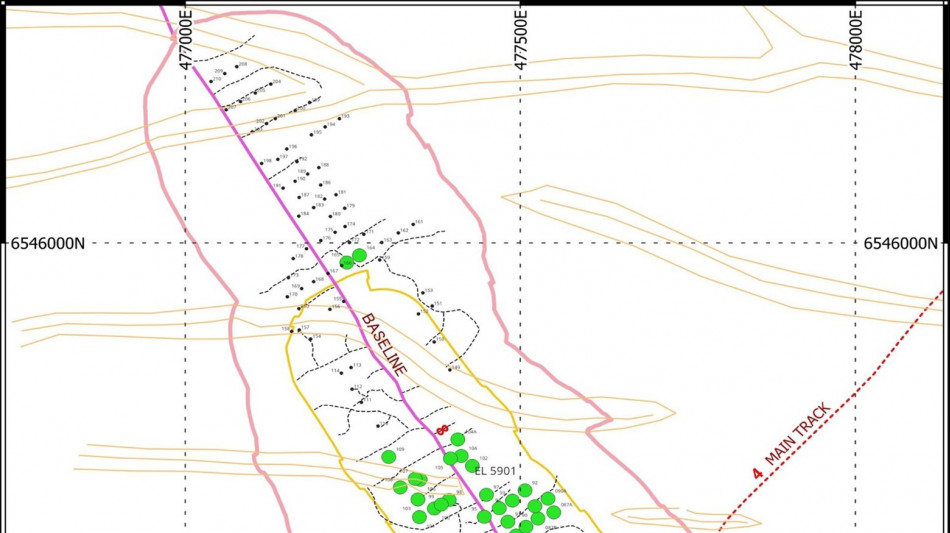

Figure 2 shows Tunkillia's key 'Stage 1' and 'Stage 2' optimised pit outlines, with the location of planned new drill hole collars (black dots) and completed drill holes (green dots) for the initial ~18,000m drilling program. The program is targeting the upgrade of all 'Stage 1' and 'Stage 2' mineralisation to JORC 'Indicated' category, with the highest value subset of 'Stage 1' mineralisation upgraded to JORC 'Measured' category. Previous drilling in the highest value 'Stage1' area by Barton and others has yielded assays such as 10m @ 15.7 g/t Au from 54m, 9m @ 6.57 g/t Au from 72m, 17m @ 5.90 g/t Au from 79m, and 15m @ 7.64 g/t Au from 100m depth. 1

The current drilling program is advancing ahead of schedule and under budget, with a total ~12,000m drilling completed across a total 37 days' drilling, for an average of approximately 325m per day. A first batch of drilling assays from the central highest value 'Stage 1' area is anticipated to be received during the coming weeks.

A 2 nd stage RC drilling planned for March to June 2026 will then target conversion of all other Tunkillia OSS mineralisation to JORC 'Indicated' category. Concurrent diamond drilling ( DD ) will infill and expand Tunkillia's geotechnical and metallurgical databases to support further pit design optimisation and feasibility studies.

Figure 2 - Tunkillia S1 & S2 'Starter Pits' with planned (black dots) and completed (green dots) drilling

Authorised by the Managing Director of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 2.2Moz Au & 3.1Moz Ag JORC Mineral Resources (79.9Mt @ 0.87g/t Au), brownfield mines, and 100% ownership of the region's only gold mill in the renowned Gawler Craton of South Australia. *

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy ( AusIMM ), Australian Institute of Geoscientists ( AIG ) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 ( JORC ).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (above 215mRL) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (below 90mRL) | Mr Dale Sims | AusIMM / AIG | Fellow / Member |

Wudinna Mineral Resource (Clarke Deposit) | Ms Justine Tracey | AusIMM | Member |

Wudinna Mineral Resource (all other Deposits) | Mrs Christine Standing | AusIMM / AIG | Member / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. In accordance with ASX Listing Rule 5.19.2, the Company further confirms that the material assumptions underpinning any production targets and the forecast financial information derived therefrom continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

1 Refer to Prospectus and ASX announcement dated 15 November 2021

* Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 8 September 2025. Total Barton JORC (2012) Mineral Resources include 1,049koz Au (39.7Mt @ 0.82 g/t Au) in Indicated category and 1,186koz Au (40.2Mt @ 0.92 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

SOURCE: Barton Gold Holdings Limited

View the original press release on ACCESS Newswire

S.Weaver--TFWP