RYCEF

0.2800

Targeting Phase 1 commissioning by the end of 2026

HIGHLIGHTS

Existing fully permitted Central Gawler Mill adjacent to brownfield Challenger mines

Challenger JORC (2012) Mineral Resources Estimate now 313koz Au (10.6Mt @ 0.92 g/t), including 194koz Au (1.87Mt @ 3.23 g/t) in existing open pit and underground mines, where:

Challenger Main Open Pit: 70,000oz Au (0.65Mt @ 3.36 g/t Au);

Challenger West Open pit: 11,600oz Au (0.03Mt @ 10.7 g/t Au);

Challenger Underground (above 215mRL): 89,400oz Au (0.98Mt @ 2.84 g/t Au); and

Challenger Deeps (below 90mRL): 23,000oz Au (0.21Mt @ 3.50 g/t Au).

Historical tailings storage facility with coarse, higher-grade tailings up to 0.6 - 1.0 g/t Au

Evaluating de-risked, two phase transition to operations with initial tailings reprocessing ('Phase 1') followed by the introduction of high-grade (~3 g/t) fresh ore ('Phase 2')

Targeting Phase 1 commissioning by end of 2026; credit finance conversations underway

Targeting Phase 1 commissioning by the end of 2026

HIGHLIGHTS

Existing fully permitted Central Gawler Mill adjacent to brownfield Challenger mines

Challenger JORC (2012) Mineral Resources Estimate now 313koz Au (10.6Mt @ 0.92 g/t), including 194koz Au (1.87Mt @ 3.23 g/t) in existing open pit and underground mines, where:

Challenger Main Open Pit: 70,000oz Au (0.65Mt @ 3.36 g/t Au);

Challenger West Open pit: 11,600oz Au (0.03Mt @ 10.7 g/t Au);

Challenger Underground (above 215mRL): 89,400oz Au (0.98Mt @ 2.84 g/t Au); and

Challenger Deeps (below 90mRL): 23,000oz Au (0.21Mt @ 3.50 g/t Au).

Historical tailings storage facility with coarse, higher-grade tailings up to 0.6 - 1.0 g/t Au

Evaluating de-risked, two phase transition to operations with initial tailings reprocessing ('Phase 1') followed by the introduction of high-grade (~3 g/t) fresh ore ('Phase 2')

Targeting Phase 1 commissioning by end of 2026; credit finance conversations underway

ADELAIDE, AU / ACCESS Newswire / September 28, 2025 / Barton Gold Holdings Limited (ASX:BGD)(OTCQB:BGDFF)(FRA:BGD3) (Barton or Company) is pleased to announced that a Definitive Feasibility Study (DFS) has started, targeting 'Stage 1' production utilising the fully permitted Central Gawler Mill (CGM) located at Barton's South Australian Challenger Gold Project (Challenger).

The JORC (2012) Mineral Resource Estimate (MRE) for Challenger was recently upgraded to 313koz Au, including 194koz Au high-grade fresh ore (~3.2 g/t Au) in or adjacent to existing serviceable open pit and underground development, and an historical Tailings Storage Facility 1 (TSF1) containing 56koz Au at a grade of 0.54 g/t Au.2

Barton is targeting March 2026 DFS completion and end of 2026 CGM commissioning, with 'Phase 1' operations reprocessing TSF1 materials, and 'Phase 2' then introducing fresh ore. Altris Pty Ltd (Altris) has been appointed to lead the DFS, with SRK Consulting (Australasia) Pty Ltd (SRK Consulting) completing TSF1 mining studies, Tetra Tech Coffey Pty Ltd (Tetra Tech Coffey) designing a tailings storage lift, and GPA Engineering Pty Ltd (GPA) supporting engineering, metallurgy and process plant design. Technical site visits will begin this week.

Full details are contained in the complete announcement, which can be accessed on the ASX website, the investor section of Barton's website, or directly by clicking here.

Commenting on the start of the Stage 1 DFS, Barton Managing Director Alexander Scanlon said:

"With gold prices at all-time highs and over 300koz Au JORC Resources adjacent to the Central Gawler Mill, the opportunity to leverage our existing infrastructure to operations and cash flow has never been more attractive.

"We are wasting no time pursuing this opportunity, targeting a low-cost and low-risk transition to operations by the end of 2026, the re-rating of Barton's equity to a 'producer' profile, and operating free cash flows to fund our planned regional growth at Tunkillia. We look forward to sharing regular updates during an exciting 18 months ahead."

Authorised by the Managing Director of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

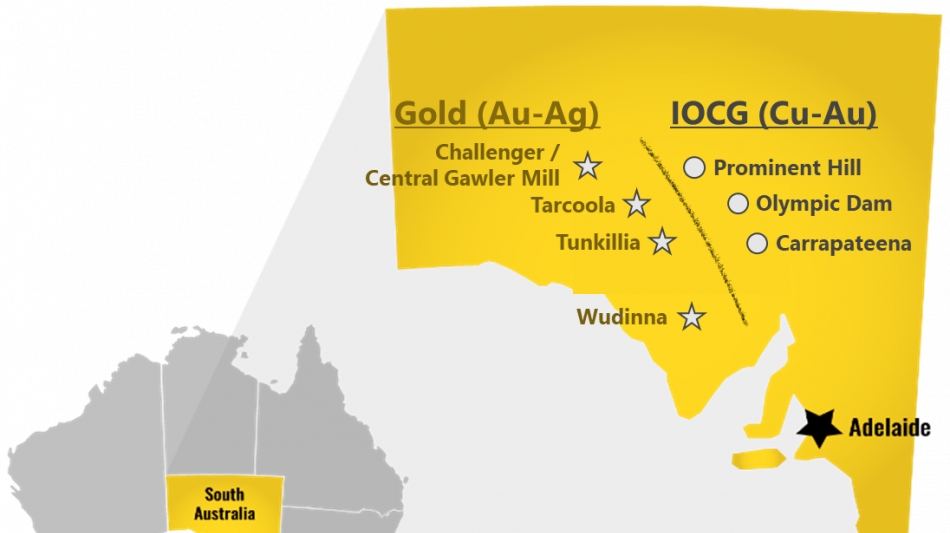

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 2.2Moz Au & 3.1Moz Ag JORC Mineral Resources (79.9Mt @ 0.87g/t Au), brownfield mines, and 100% ownership of the region's only gold mill in the renowned Gawler Craton of South Australia.*

Challenger Gold Project

Tarcoola Gold Project

Tunkillia Gold Project

Wudinna Gold Project

|  |

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (above 215mRL) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (below 90mRL) | Mr Dale Sims | AusIMM / AIG | Fellow / Member |

Wudinna Mineral Resource (Clarke Deposit) | Ms Justine Tracey | AusIMM | Member |

Wudinna Mineral Resource (all other Deposits) | Mrs Christine Standing | AusIMM / AIG | Member / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

*Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 8 September 2025. Total Barton JORC (2012) Mineral Resources include 1,049koz Au (39.7Mt @ 0.82 g/t Au) in Indicated category and 1,186koz Au (40.2Mt @ 0.92 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

SOURCE: Barton Gold Holdings Limited

View the original press release on ACCESS Newswire

F.Carrillo--TFWP