RIO

2.9900

VANCOUVER, BC / ACCESS Newswire / August 25, 2025 / Avino Silver & Gold Mines Ltd. (TSX:ASM)(NYSE American:ASM)(FSE:GV6) ("Avino" or the "Company"), a long-standing silver producer in Mexico, is pleased to announce that the Company has acquired 100% ownership of its La Preciosa project ("La Preciosa") by purchasing and extinguishing all of the outstanding royalties and contingent payment obligations (the "La Preciosa Obligations"), currently held by Deterra Royalties Limited (DRR) ("Deterra") (collectively, the "Transaction"). The consideration for this royalty purchase is a $13.25 million upfront payment followed by an $8.75 million payment deferred for one year. This second payment was already accounted for in the existing royalty agreement with Deterra.

Highlights of this transaction:

Restores full value and control of La Preciosa

Optimizes financial structure

Enhances project economics

Reduces administrative burdens

Manageable impact on financial liquidity

"Avino has seized upon a unique opportunity to buy back all the royalties on La Preciosa" said David Wolfin, President and CEO. "This cornerstone asset is now materially unencumbered, and this transaction represents a unique investment opportunity for Avino, as operators rarely get the chance to increase project value through the purchase of previously-granted royalties. By eliminating the royalty burden immediately prior to commencing production, we believe we will generate meaningful returns on our investment by lowering La Preciosa's operating cost profile, and ensuring that as much of La Preciosa's value remains with the operator and its stakeholders. The incremental cash outlay of only US$13.25 million represents an acquisition that is accretive to Avino shareholders on a net asset value (NAV) per share basis. The current metal price environment has enabled Avino to generate significant profits and cash flows from its current Avino mine operations, leading to the strongest balance sheet in the Company's history and granting the ability to pursue investment opportunities that enhance shareholder value such as this. I would like to thank Deterra for being great partners as our team continued to advance La Preciosa on its way to production and I am thrilled to have reached an agreement where it was a win for both parties."

The La Preciosa Obligations are comprised of:

a cash payment of US$8.75 million, to be paid no later than 12 months after initial production at La Preciosa (the "Contingent Production Payment");

a 1.25% net smelter returns royalty on the Gloria and Abundancia areas of La Preciosa, and a 2.00% gross value returns royalty on all other areas of La Preciosa; and

a payment of US$0.25 per silver equivalent ounce (subject to inflationary adjustment) of new mineral reserves (as defined by NI 43-101) discovered and declared outside of the current mineral resource area at La Preciosa, subject to a cap of US$50 million, with any such payments to be credited against any existing or future payments owing on the gross value returns royalty.

Background to the Transaction

The La Preciosa Obligations were initially issued to Coeur Mining, Inc. ("Coeur") in connection with the acquisition of La Preciosa by Avino in March 2022. Details of the Company's acquisition of La Preciosa are available on the Company's website here. Following the acquisition, Coeur sold the La Preciosa Obligations to Trident Royalties Plc ("Trident") in May 2023, with Deterra subsequently acquiring the La Preciosa Obligations by way of its acquisition of Trident in September 2024.

Transaction Consideration

Avino acquired the La Preciosa Obligations from Deterra for immediate cash consideration of US$13.25 million (the "Upfront Payment"), plus an additional US$8.75 million in cash payable on the one-year anniversary of the closing of the Transaction (the "Deferred Payment"). The Upfront Payment was funded with Avino's existing cash on hand, which was approximately US$48 million, immediately prior to this acquisition. The Deferred Payment was structured to substantially mirror the pre-existing Contingent Production Payment which Avino expects to pay by the end of 2026, given that initial production at La Preciosa is targeted in late 2025. As such, Avino believes the net cash investment for the purchase and extinguishment of the La Preciosa Obligations to be the Upfront Payment, with the Contingent Production Payment already considered in the Company's capital allocation for the coming years. The Deferred Payment is expected to be funded with cash on hand.

Transaction Rationale

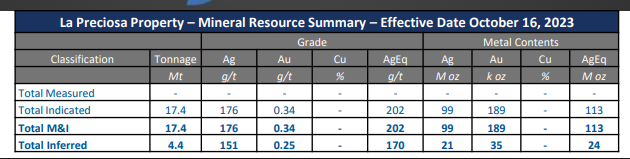

Avino has made excellent progress advancing La Preciosa with first production expected by the end of 2025 and significant production growth expected in the years thereafter which will see La Preciosa become a cornerstone asset for the Company. La Preciosa is one of the largest undeveloped silver resources in Mexico (see current NI 43-101 Resource Estimate below)located adjacent to Avino's existing mine and infrastructure. Eliminating the 1.25% net smelter returns royalty on the Gloria and Abunduncia veins and the 2.00% gross value returns royalty on the remainder of the La Preciosa resource will meaningfully lower La Preciosa's cash production costs, as well as remove any future potential obligations if new reserves are discovered outside of the current resource area.

Notes:

The stated mineral resources are classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum's "CIM Definition Standards - For Mineral Resources and Mineral Reserves" and are more particularly described in the Company's February 5, 2024 Prefeasiblity Study, available under the Company's profile at www.sedarplus.ca.

Mineral resources for La Preciosa are estimated at a cut-off grade of 120 g/t AgEq.

Mineral resources for La Preciosa are estimated using a long-term silver price of US$19.00/oz and a long-term gold price of US$1,750/oz.

Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Tonnage and metal content figures are expressed in thousands and may not add up due to rounding.

La Preciosa Development Update

As seen in our latest press release dated July 22, 2025, blasting and construction of the relatively short 360 meter San Fernando main access decline is underway, and equipment mobilization has been swift, allowing development to advance on plan. The new jumbo drill is working on this ramp as it progresses toward intercepting the Gloria and Abundancia veins. Recent photos showcasing the work at La Preciosa are available on the Avino website - click here to view them.

A surface drill has been deployed to La Preciosa and drilling is expected to continue until the end of October. The drilling information will be utilized in underground mine planning and 3D modelling. The Company is also planning to update the current mineral resource estimate for Avino and La Preciosa was well as releasing its first mineral reserve estimate at the same time as the Company has now met the requirements for a Producing Issuer under the NI 43-101 standards of disclosure for mineral projects.

A more comprehensive drilling update will be released in the coming weeks.

Qualified Person(s)

Peter Latta, P.Eng., MBA, Avino's VP Technical Services, is a qualified person within the context of National Instrument 43-101, has reviewed and approved the technical data in this news release.

About Avino

Avino is a silver producer from its wholly owned Avino Mine near Durango, Mexico. The Company's silver, gold and copper production remains unhedged. The Company intends to maintain long term sustainable and profitable mining operations to reward shareholders and the community alike through our growth at the historic Avino Property and the strategic acquisition of the adjacent La Preciosa which was finalized in Q1 2022. Avino has a large silver equivalent resource base with consolidated mineral resources of 277 million AgEq ounces in the measured and indicated mineral resource category and 94 million AgEq ounces in the inferred mineral resource category. Early in 2024, the pre-feasibility Study on the Oxide Tailings Project was completed. This study represents a key milestone in our growth trajectory. As part of Avino's commitment to adopting sustainable practices, we have been operating a dry-stack tailings facility for more than two years with excellent results. We are committed to managing all business activities in a safe, environmentally responsible, and cost-effective manner, while contributing to the well-being of the communities in which we operate. We encourage you to connect with us on X (formerly Twitter) at @Avino_ASM and on LinkedIn at Avino Silver & Gold Mines. To view the Avino Mine VRIFY tour, please click here.

For Further Information, Please Contact:

Investor Relations

Tel: 604-682-3701

Email: [email protected]

This news release contains "forward-looking information" and "forward-looking statements" (together, the "forward looking statements") within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995. This information and these statements, referred to herein as "forward-looking statements" are made as of the date of this document. Forward-looking statements relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to the Company's payment of US$8.75 million in cash to Deterra within 12 months from Closing. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as "expects", "anticipates", "plans", "projects", "estimates", "envisages", "assumes", "intends", "strategy", "goals", "objectives" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. These forward-looking statements are made as of the date of this news release. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the future circumstances, outcomes or results anticipated in or implied by such forward-looking statements will occur or that plans, intentions or expectations upon which the forward-looking statements are based will occur. While we have based these forward-looking statements on our expectations about future events at the date that such statements were prepared, the statements are not a guarantee that such future events will occur and are subject to risks, uncertainties, assumptions and other factors which could cause events or outcomes to differ materially from those expressed or implied by such forward-looking statements.

Cautionary note to U.S. Investors concerning estimates of Mineral Reserves and Mineral Resources

All reserve and resource estimates reported by Avino were estimated in accordance with the Canadian National Instrument 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards. The U.S. Securities and Exchange Commission ("SEC") now recognizes estimates of "measured mineral resources," "indicated mineral resources" and "inferred mineral resources" and uses new definitions of "proven mineral reserves" and "probable mineral reserves" that are substantially similar to the corresponding CIM Definition Standards. However, the CIM Definition Standards differ from the requirements applicable to US domestic issuers. US investors are cautioned not to assume that any "measured mineral resources," "indicated mineral resources," or "inferred mineral resources" that the Issuer reports are or will be economically or legally mineable. Further, "inferred mineral resources" are that part of a mineral resource for which quantity and grade are estimated on the basis of limited geologic evidence and sampling. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Avino Silver & Gold Mines Ltd.

View the original press release on ACCESS Newswire

M.McCoy--TFWP