RYCEF

0.2800

Revenue increased 67% y/y to $17.1M with Positive Adjusted EBITDA1 for Ninth Consecutive Quarter

Adjusted EBITDA1 increased 387% y/y to $2.9M or 17% of revenue

Net Profit for the quarter of $0.9M and EPS of $0.02

Reaffirms Fiscal 2025 Revenue Guidance Exceeding $60M, Driven by Strong Order Pipeline

TORONTO, ONTARIO / ACCESS Newswire / August 13, 2025 / Electrovaya Inc. ("Electrovaya" or the "Company") (Nasdaq:ELVA)(TSX:ELVA), a leading lithium-ion battery technology and manufacturing company, today reported its financial results for the third quarter of the fiscal year ending September 30, 2025 ("Q3 2025"). All dollar amounts are in U.S. dollars unless otherwise noted.

Financial Highlights:

Revenue for Q3 2025 was $17.1 million, compared to $10.3 million in Q3 2024, an increase of 67%. Year to date revenue was $43.3 million compared to $33.0 million in the prior year, an increase of 31%

Gross margin was 30.8% in Q3 2025. Battery system margins remained strong at 30.9% for the quarter.

Adjusted EBITDA1 was $2.9 million or 17% of revenue with growth of 387% year over year.

Net profit for the quarter was $0.9 million, compared to a net loss in the prior year of $0.3 million. Year to date net profit was $1.3 million compared to a net loss of $1.4 million in the prior year.

Earnings per share for the quarter was $0.02.

Key Operational and Strategic Highlights - Q3 2025

Continued Growth from OEM Partners and Leading End-Customers: Electrovaya maintained strong momentum with its key OEM partners and end customers in the material handling sector. In Q3, the Company secured more than $21 million in orders, bringing total orders to over $66 million in the nine months ending June 30th 2025. The Company continues to expand its robust sales pipeline, leveraging long-standing relationships with major OEMs and top-tier end customers.

Expanded Manufacturing Capacity and Output: To meet growing demand, Electrovaya implemented a second production shift at its Mississauga facility in mid-June and commenced assembly operations in Jamestown, NY in May. These initiatives will increase output for material handling battery systems and support the launch of new products for additional vertical markets

Infinity Technology Advancements: The Company continued to enhance its Infinity product line, achieving UL certification for more than 400 battery systems equipped with its latest high-capacity lithium-ion cells. New models feature improved ergonomics and AI-enabled capabilities, further strengthening Electrovaya's competitive edge.

Development of New Products for Emerging Verticals: Electrovaya is leveraging its industry-leading Infinity technology to expand into a broader range of high-growth applications, including:

Robots and Autonomous Vehicles: The Company has introduced multiple battery system products for new robotic vehicle platforms across three distinct OEM customers. Applications range from material handling to surveillance systems. This initiative is part of a major product development program aimed at capturing share in the rapidly growing robotics market.

Airport Ground Equipment: Recently, Electrovaya launched products targeting the airport ground support segment and plans to showcase these solutions at the upcoming GSE Expo in Las Vegas this September.

Class 8 Trucks: As one of the largest potential markets for electrification, this segment represents a significant growth opportunity. Electrovaya has entered into a partnership with Janus Electric Holdings Limited, an Australian pioneer in heavy-vehicle electrification. The Company is developing custom high-voltage battery systems for a unique battery-swapping application in both U.S. and Australian markets.

Construction and Mining Equipment: Through its partnership with Sumitomo Corporation Power and Mobility, Electrovaya is pursuing opportunities with multiple Japan-based OEMs in these sectors.

Defense Applications: The Company continues to expand its collaboration with a global defense contractor on various electrification projects. With its superior safety and cycle life advantages, combined with upcoming U.S.-based lithium-ion battery manufacturing, Electrovaya is positioned to target the defense sector on a larger scale in the near term.

Jamestown Cell Manufacturing Update: The Company remains on track for start of cell manufacturing in mid calendar year 2026. Output from the Jamestown facility will remain eligible for 45X under the OBBB Act (2025).

Management Commentary:

"Our Q3 FY2025 results reflect the strong momentum we've built, with continued growth in both revenue and profitability, while advancing our industry-leading Infinity technology into a broader range of applications," said Dr. Raj DasGupta, Electrovaya's CEO. "The market is increasingly recognizing the exceptional advantages of our innovations. Electrovaya's unique lithium-ion technology delivers the ideal solution for the most demanding equipment in the world. With the rise of AI and rapid expansion across sectors like e-commerce and robotics, we are well-positioned to provide superior battery solutions that power these high-growth industries."

"FY Q3 2025 quarter was our ninth consecutive quarter of positive adjusted EBITDA1 and also our second consecutive quarterly net profit. Margins remained robust at above 30%, a trend that we expect to continue and strengthen over time.," stated John Gibson, Electrovaya's CFO. "Our second shift at our Mississauga operations, combined with the start up of assembly operations in Jamestown will continue to support increased manufacturing output as we complete our fiscal year and prepare for FY2026. We are confident in our ability to exceed $60 million in revenue for FY 2025 while advancing profitability and scaling operations."

Positive Financial Outlook & Fiscal 2025 Guidance:

The Company anticipates strong growth into FY 2025 with estimated revenues to exceed $60 million driven by renewed demand from the Company's largest end users of material handling batteries. This guidance considers its existing purchase orders, along with anticipated orders in its pipeline from key end users and customers. This guidance also takes into consideration a percentage of anticipated revenue that may be deferred to FY 2026 (please see Forward Looking Statements for further clarification).

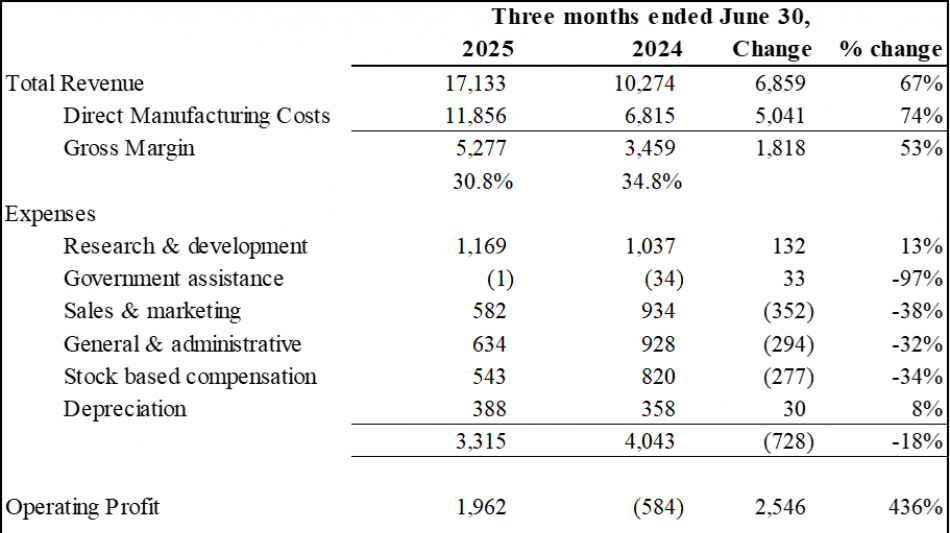

Selected Financial Information for the quarters ended June 30, 2025 and 2024:

Results of Operations

(Expressed in thousands of U.S. dollars)

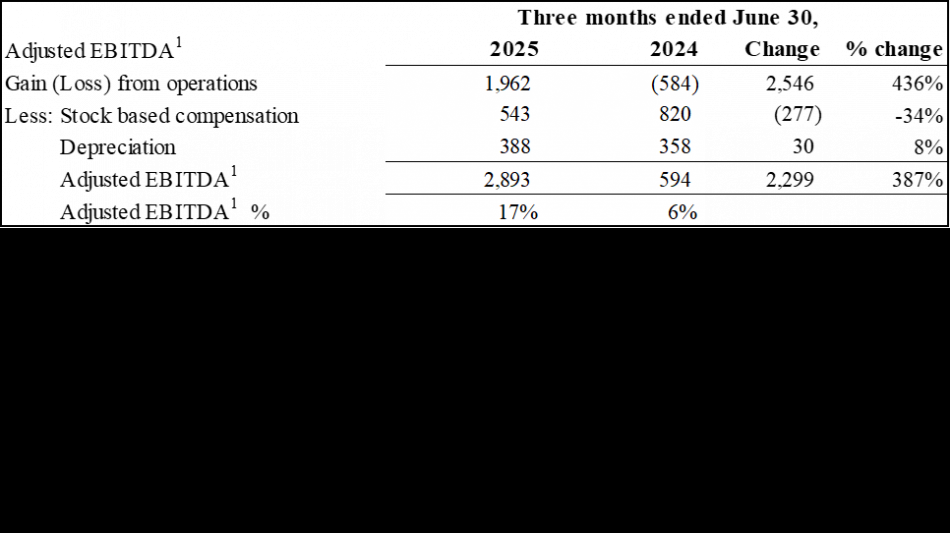

Adjusted EBITDA1

(Expressed in thousands of U.S. dollars)

1 Non-IFRS Measure: Adjusted EBITDA is defined as income/(loss) from operations, plus stock-based compensation costs and depreciation and amortization costs. Adjusted EBITDA does not have a standardized meaning under IFRS. Therefore it is unlikely to be comparable to similar measures presented by other issuers. Management believes that certain investors and analysts use adjusted EBITDA to measure the performance of the business and is an accepted measure of financial performance in our industry. It is not a measure of financial performance under IFRS, and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to IFRS measures. The most directly comparable measure to Adjusted EBITDA calculated in accordance with IFRS is income (loss) from operations.

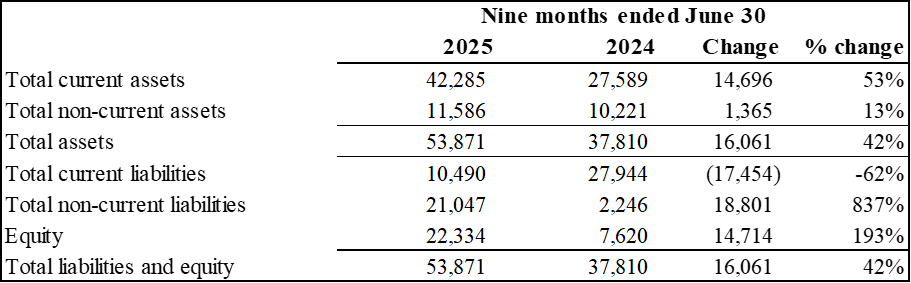

Summary Financial Position

(Expressed in thousands of U.S. dollars)

The Company's complete Financial Statements and Management Discussion and Analysis for the quarter and nine months ended June 30, 2025 are available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov, as well as on the Company's website at www.electrovaya.com.

Conference Call details:

Date: Wednesday, August 13, 2025

Time: 5:00 pm. Eastern Time (ET)

Toll Free: 888-506-0062

International: 973-528-0011

Participant Access Code: 264442

Webcast link: https://www.webcaster4.com/Webcast/Page/2975/52770

To help ensure that the conference begins in a timely manner, please dial in 10 minutes prior to the start of the call.

For those unable to participate in the conference call, a replay will be available for two weeks beginning on August 13, 2025 through August 27, 2025. To access the replay, the dial-in number is 877-481-4010 and 919-882-2331. The replay passcode is 52770.

Investor and Media Contact:

Jason Roy

VP, Corporate Development and Investor Relations

Electrovaya Inc.

[email protected] / 905-855-4618

About Electrovaya Inc.

Electrovaya Inc. (NASDAQ:ELVA)(TSX:ELVA) is a pioneering leader in the global energy transformation, focused on contributing to the prevention of climate change by supplying safe and long-lasting lithium-ion batteries without compromising energy and power. The Company has extensive IP and designs, develops and manufactures proprietary lithium-ion batteries, battery systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications. Electrovaya has two operating sites in Canada and a 52-acre site with a 135,000 square foot manufacturing facility in Jamestown New York state for its planned gigafactory. To learn more about how Electrovaya is powering mobility and energy storage, please explore www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements, including statements that relate to, among other things, revenue growth and revenue guidance of approximately $60 million in FY 2025, other financial projections, including projected sales, cost of sales, gross margin, working capital, cash flow, and overheads anticipated in FY 2025, the expected timing of deliveries of pre-production battery modules in Japan, anticipated cash needs and the Company's requirements for additional financing, purchase orders, mass production schedules, funding from EXIM and the ability to satisfy the conditions to drawing on any facility entered into with EXIM,, use of proceeds of the EXIM facility,, ability to deliver to customer requirements. Forward-looking statements can generally, but not always, be identified by the use of words such as "may", "will", "could", "should", "would", "likely", "possible", "expect", "intend", "estimate", "anticipate", "believe", "plan", "objective" and "continue" (or the negative thereof) and words and expressions of similar import. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors and assumptions are applied in making forward looking statements, and actual results may differ materially from those expressed or implied in such statements. In making the forward-looking statements included in this news release, the Company has made various material assumptions, including but not limited to assumptions with respect to the Company's customers deploying its products in accordance with communicated intentions, the Company's customers completing new distribution centres in accordance with communicated expectations, intentions and plans, anticipated new orders in FY 2025 based on customers' historical patterns and additional demand communicated to the Company and its partners, but not yet provided as a purchase order together with the Company's current firm purchase order backlog totaling approximately $80 million, a discount of approximately 25% used in the revenue modeling applied to the overall expected order pipeline to account for potential delays in customer orders, expected decreases in input and material costs combined with stable selling prices in FY 2025, delivery of ordered products on a basis consistent with past deliveries, and that the Company's customer counterparties will meet their production and demand growth targets, ]the Company's ability to successfully execute its plans and intentions, including with respect to the entry into new business segments and servicing existing customers, the availability to obtain financing on reasonable commercial terms, including any EXIM facility. Factors that could cause actual results to differ materially from expectations include but are not limited to customers not placing orders roughly in accordance with historical ordering patterns and communicated intentions, macroeconomic effects on the Company and its business, and on the lithium battery industry generally, not being able to obtain financing on reasonable commercial terms or at all, including not being able to satisfy any condition of drawdowns under any EXIM facility if entered into, that the Company's products will not perform as expected, supply and demand fundamentals for lithium-ion batteries, the risk of interest rate increases, persistent inflation in the United States and Canada and other macroeconomic challenges, the political, economic, and regulatory and business stability of, or otherwise affecting, the jurisdictions in which the Company operates, including new tariff regimes. There have been indications from the United States government of potential tariffs on Canada, Mexico and other countries, which if enacted would have a material impact on the Company. Additional information about material factors that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found in the Company's Annual Information Form for the year ended September 30, 2024 under "Risk Factors", and in the Company's most recent annual and interim Management's Discussion and Analysis under "Qualitative And Quantitative Disclosures about Risk and Uncertainties" as well as in other public disclosure documents filed with Canadian securities regulatory authorities and filed or furnished with the SEC. The Company does not undertake any obligation to update publicly or to revise any of the forward looking statements contained in this document, whether as a result of new information, future events or otherwise, except as required by law.

Revenue guidance for FY2025 described herein constitutes future‐oriented financial information and financial outlooks (collectively, "FOFI"), and generally, is, without limitation, based on the assumptions and subject to the risks set out above under "Forward‐Looking Statements". Although management believes such assumptions to be reasonable, a number of such assumptions are beyond the Company's control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management's current expectations and plans relating to the Company's future performance, and may not be appropriate for other purposes.

The FOFI does not purport to present the Company's financial condition in accordance with IFRS, and it is expected that there may be differences between audited results and preliminary results, and the differences may be material. The inclusion of the FOFI in this news release disclosure should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

SOURCE: Electrovaya, Inc.

View the original press release on ACCESS Newswire

A.Nunez--TFWP