SCS

0.0200

Norway, a major producer and supplier of energy, is well placed to help alleviate Europe's energy crisis -- and reap the profits, a situation not all of its European partners welcome.

The Nordic country was already a leading exporter of electricity thanks to its many hydroelectric dams.

But since the cut in natural gas supplies from Russia following the invasion of Ukraine, it has now emerged as Europe's main supplier in that field.

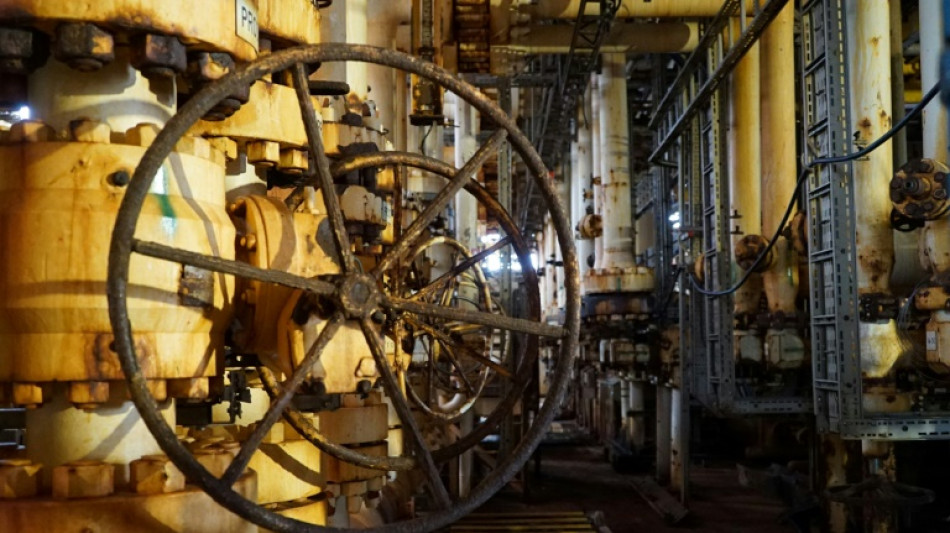

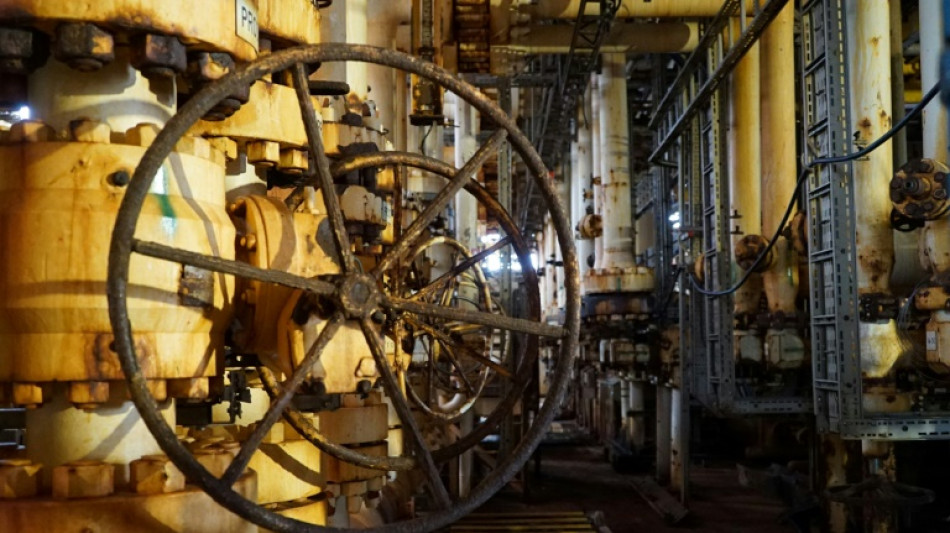

Offshore, Norwegian platforms and facilities are running at full capacity to make up at least some of the shortfall.

"The most important contribution Norway can make in the current situation is to maintain high gas production," oil and energy minister Terje Aasland told parliament last month.

The country is set to increase its gas exports by eight percent this year, bringing production to a record 122 billion cubic metres, according to Aasland.

But the sharp rise in gas prices also means greater profits.

The state's oil and gas revenues are expected to smash last year's record 830 billion Norwegian kroner ($83 billion), potentially reaching 1.5 trillion in 2022 and 1.9 trillion next year, according to projections by Nordea Markets.

- 'Gigantic profit' -

With such a spectacular windfall, there are those who worry that the country risks being viewed as a "war profiteer".

Already in May, Polish Prime Minister Mateusz Morawiecki said Norway should share "this excess, gigantic profit".

The country was "indirectly preying", albeit unintentionally, from "the war started by Putin", Morawiecki argued.

So far, Oslo has turned a deaf ear to calls for a cap on gas prices, instead emphasising its role as a stable and predictable supplier.

"Without imports from Norway, the situation in the European gas market would have been much more serious" Elisabeth Saether, state secretary for Norway's petroleum and energy ministry, told AFP.

Some countries are also worried however that Oslo is considering limiting electricity exports to Europe, when there are already concerns about winter power supplies.

Norway is not a member of the European Union, but it is closely associated through its membership of the European Economic Area.

Its power grid is linked to its Nordic neighbour Sweden and Finland, and to Denmark, Germany and the UK via long undersea cables.

However, Norway's water reservoirs this week were only 68,5 percent full, 12 percent lower than normal, after two years of low rainfall, according to the Norwegian Water Resources and Energy Directorate (NVE).

A lower production output and a higher share of the electricity going abroad means much higher energy bills for households and businesses in the south of the country, which were used to cheap kilowatt hours.

In this context then, not all Norwegians are happy about electricity being exported.

Analysts at Volue Insight have calculated that Norwegians would pay 25 percent less for their electricity this winter without the cables to Germany and the UK, which came into operation last year.

- Nordic concerns -

Norway does not support the idea of countries being left to fend for themselves in the energy market. It also opposes manipulating the market prices.

But when it comes to electricity exports, the message is a little different.

"Norway is considering measures that could limit export short term when the multi-year reservoir levels are low, to secure supply," Saether confirmed.

"This has never been done before."

The details of the restrictions have yet to be unveiled, but she gave assurances that they would respect EEA rules guaranteeing the free movement of services and goods, including electricity, between member states.

Nevertheless, the news alarmed energy grid operators in Sweden, Denmark and Finland enough to prompt them to publish a joint letter in August.

Svenska kraftnat, Energinet and Fingrid said they were "deeply concerned" that the Norwegian plan "seems not to acknowledge that it is through a well-functioning market that electricity security of supply is ensured in the most efficient way".

L.Davila--TFWP