SCS

0.0200

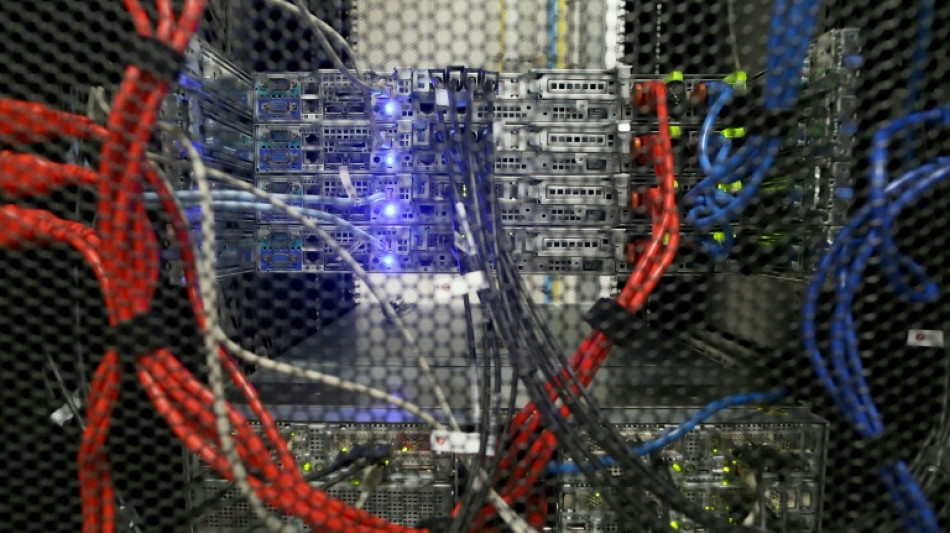

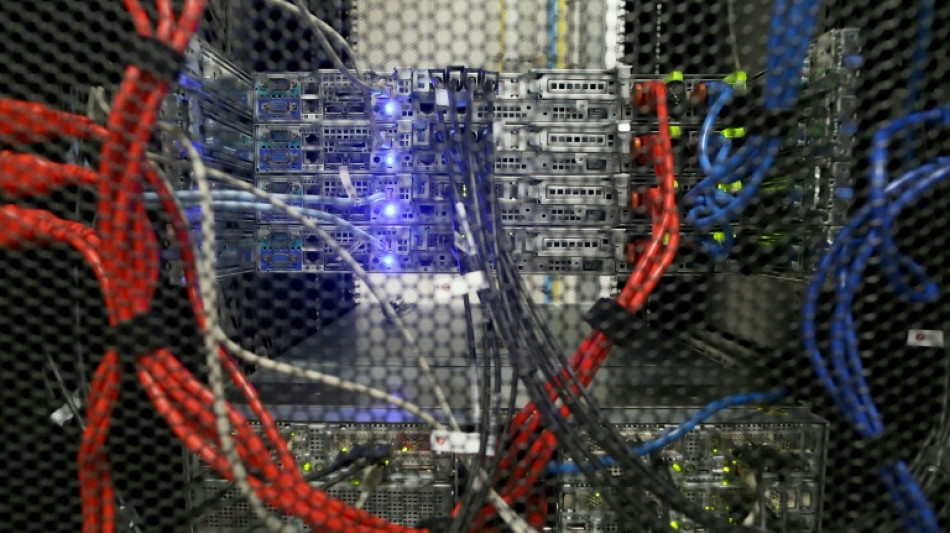

Ireland hosts one of the world's fast-growing clusters of data centres, but is running headlong into the difficult consequences.

The server farms powering global tech giants now consume a fifth of the small nation's electricity, igniting concerns over both grid stability and Ireland's commitments to boost renewable energies and cut gas emissions.

Already home to over 80 data centres, a 2024 report by US-based researchers Synergy ranked Dublin behind only the US state of Virginia and Beijing in its density of such state-of-the-art facilities built for colossal amounts of data.

Vast energy-hungry warehouses around Dublin's ring road host thousands of servers handling massive amounts of cloud computing, storage and AI demands for data giants like Google, Meta, Microsoft and Amazon.

The facilities are a quietly purring economic engine, injecting billions in investment, employment and anchoring the tech multinationals which, coupled with big pharma, fund over half of Ireland's corporate-tax take, according to analysts.

But doubts are mounting over the environmental cost.

- 'Unsustainable' -

Campaigner group Friends of the Earth told AFP such centres are "completely unsustainable".

"It's one of the fundamental climate justice issues of our times," said spokesperson Rosi Leonard.

Data centres' share of Irish metered electricity consumption reached 22 percent by 2024, compared to an EU-wide average of 2-3 percent, according to official data.

National grid operator EirGrid projects that data centres could account for 30 percent of demand by 2030 as the growth of artificial intelligence technology accelerates.

That is equivalent to powering two million homes for a full year, energy analysts Wood Mackenzie said in July.

Some data centres in high-pressure areas in Dublin have already turned to generators for back-up, which are usually gas and oil-powered, said Leonard.

That could hamper Ireland's already fraught efforts to meet EU 2030 climate targets that threaten multi-billion euro fines if missed.

Leonard said the server farms are also gobbling up much of the renewable energy like wind and solar that is being added to the grid.

"We want a moratorium on further expansion of data centres until they pose no threat to our climate and carbon budgets," she said.

- 'Limbo' -

EirGrid plans capacity upgrades to accommodate future data centre demand more evenly nationwide. And the government has said a new strategy will be published soon with a pledge to update the grid within five years.

But experts doubt whether those plans will deliver in time to meet demand.

As Ireland aims "to reduce emissions... expanding a sector that's going to increase emissions very significantly just... doesn't make sense," said Barry McMullin, a climate change expert at Dublin City University.

Data centre compatibility with emissions goals "is unlikely for another decade", he told AFP.

Some planning authorities have already pushed back.

Last year, a local council in Dublin refused a Google data centre development, citing "insufficient (grid) capacity" and a "lack of significant on-site renewable energy".

Ireland's digital sector contributes an estimated 13 percent to GDP.

But Maurice Mortell, head of Digital Infrastructure Ireland (DII), a group representing data centres, warns the nation could lose out on AI-driven investment due to grid and planning blockages.

"We've over 18 billion euros ($21 billion) of investment in digital infrastructure here already, with another 5.8 billion planned, but without power, so potentially marooned," he said.

"Ireland's lead, particularly in cloud computing, is at risk," he told AFP, highlighting its fading appeal and frustrations from large US firms.

"Our sector is in limbo, we need a grid that's capable, and a clear policy environment," he said.

- Waste heat -

A 2022 government strategy paper said data centres should demonstrate a "clear pathway to decarbonise" and "net-zero data services by design".

Meanwhile, a project launched in 2023 by Amazon Web Services (AWS) in partnership with a local Dublin authority shows how some climate impacts could be offset.

Waste heat provided from an AWS data centre is carried via hot water through pipes to a local heating hub next door to heat offices and a library, and soon hundreds of homes.

"There is potential for other data centres to do the same," said Admir Shala, a project manager at the heating hub called Heatworks.

But expert McMullin was sceptical.

"We don't really have heat networks to plug this waste heat into," he said, adding that data centres run year-round whereas homes only need to be heated for about six months a year.

A.Williams--TFWP