RBGPF

0.1000

Wall Street stocks finished mixed at the end of a choppy session Thursday as markets digested varying labor market data and looked ahead to next week's Federal Reserve decision.

Strong gains by Facebook parent Meta and tech giant Salesforce helped lift the Nasdaq into positive territory, while the Dow finished slightly lower.

Earlier, bourses in London, Paris and Frankfurt all pushed higher.

A weekly report of initial US jobless claims showed a drop of 27,000. That upbeat figure came on the heels of data on Wednesday from private payroll firm ADP that showed a surprise decline in hiring last month.

A separate report Thursday by the executive placement firm Challenger, Gray & Christmas showed a jump in job cuts in November, lifting the 2025 total to the highest level since 2020.

"The market is trying to figure out how to interpret the jobs data today," said Tom Cahill of Ventura Wealth Management. "There's some confusion."

Cahill said widespread expectations that the Fed will cut interest rates next week is "putting a floor under equity prices and other risk assets."

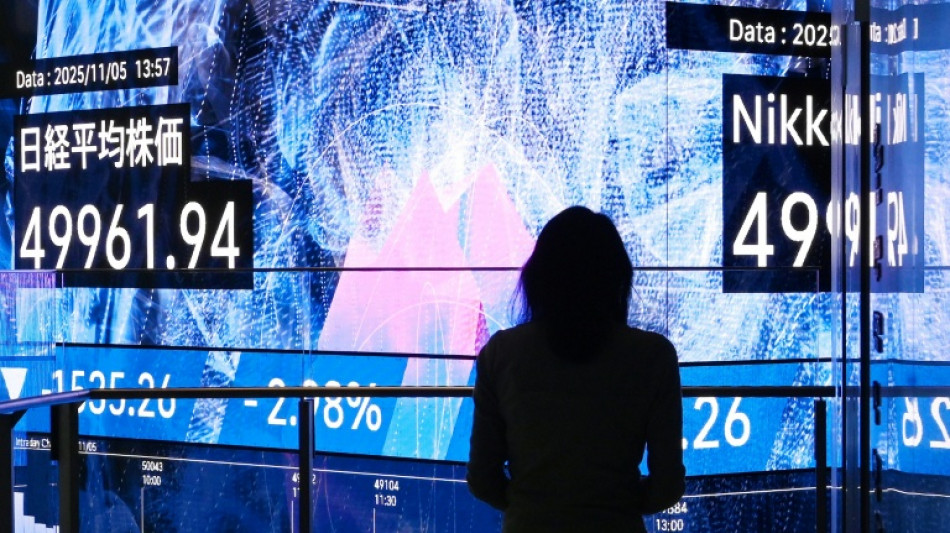

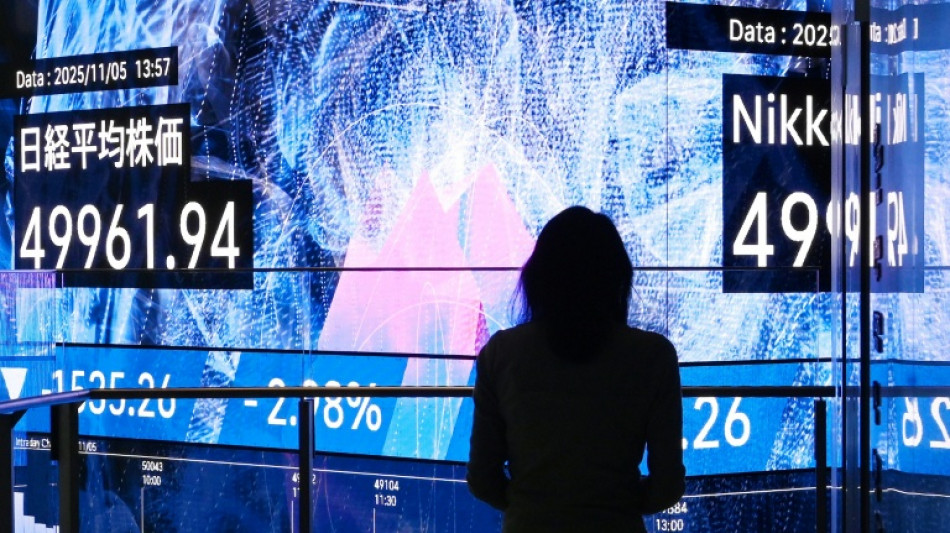

Tokyo earlier rallied more than two percent in a positive Asian session which also saw Hong Kong, Sydney, Taipei and Bangkok finish higher.

A healthy 30-year Japanese government bond sale provided some support as it slightly eased tensions about a possible rate hike by the central bank this month. The news compounded a strong response to a 10-year auction earlier in the week that settled some nerves.

Elsewhere, oil prices advanced about one percent, with analysts pointing to uncertainty over the prospects for diplomatic efforts to end the Russia-Ukraine war.

Shares in Meta rose 3.4 percent after a report that the Facebook parent is significantly cutting back on virtual-reality investments in a pivot toward artificial intelligence.

According to Bloomberg, Meta plans to cut its Metaverse costs by 30 percent -- news that drove its share price up as much as four percent in Thursday trading on Wall Street.

Salesforce jumped 3.7 percent as the tech giant raised its full-year sales forecast.

- Key figures at around 2115 GMT -

New York - Dow: DOWN 0.1 percent at 47,850.94 (close)

New York - S&P 500: UP 0.1 percent at 6,857.12 (close)

New York - Nasdaq Composite: UP 0.2 percent at 23,505.14 (close)

London - FTSE 100: UP 0.2 percent at 9,710.87 (close)

Paris - CAC 40: UP 0.4 percent at 8,122.03 (close)

Frankfurt - DAX: UP 0.8 percent at 23,882.03 (close)

Tokyo - Nikkei 225: UP 2.3 percent at 51,028.42 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,935.90 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,875.79 (close)

Euro/dollar: DOWN at $1.1648 from $1.1671 on Wednesday

Pound/dollar: DOWN at $1.3335 from $1.3353

Dollar/yen: DOWN at 155.03 yen from 155.25 yen

Euro/pound: DOWN at 87.00 pence from 87.40 pence

Brent North Sea Crude: UP 0.9 percent at $63.26 per barrel

West Texas Intermediate: UP 1.1 percent at $59.67 per barrel

J.P.Estrada--TFWP