RBGPF

0.1000

Wall Street stocks mostly rose Tuesday as optimism over a likely end to the US government shutdown offset weakness in some leading technology equities.

After Monday's rally, US stocks opened mostly lower on lingering unease about the stratospheric valuation growth of major players in artificial intelligence.

Those worries ebbed a bit as the session progressed, with some large tech equities finishing in positive territory. But the tech-heavy Nasdaq Composite was down 0.3 percent, the only one of the three main US indices to retreat.

"There's definitely concern over valuations but that valuations don't mean the market's going to sell off," said Tim Urbanowicz of Innovator Capital Management, adding "it just leaves a lot less room for bad news."

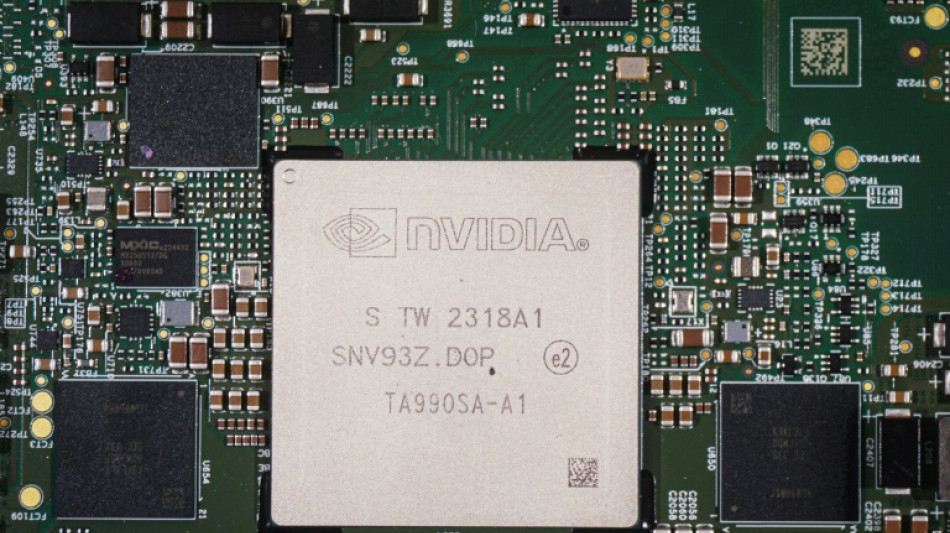

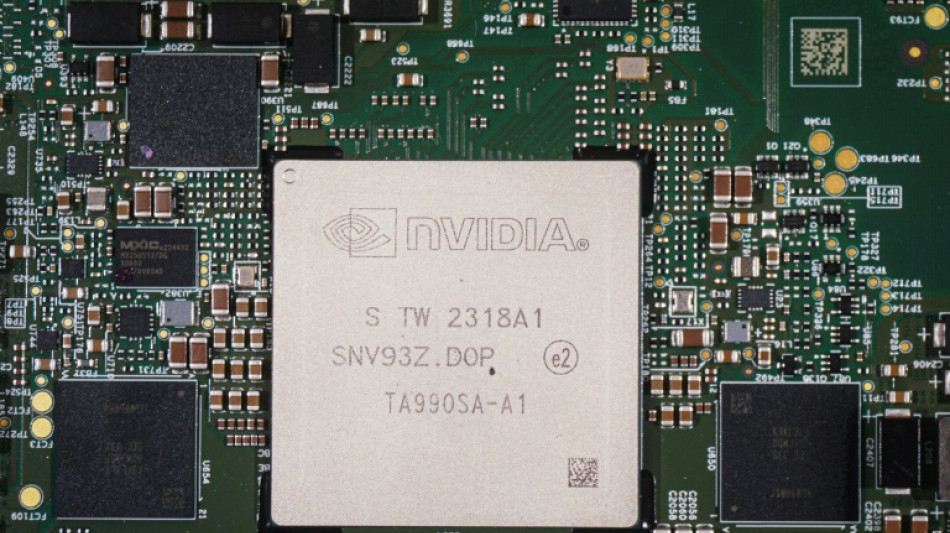

Japan's SoftBank announced it sold $5.8 billion worth of shares in US chip giant Nvidia last month. SoftBank did not give a reason for the Nvidia stock sale in its earnings statement.

Shares in Nvidia, whose processors are prized by companies training and operating AI models, fell 3.0 percent.

"For the wider investment community, when big investors cash out of their AI positions, they will take notice, and this is why the stock is declining today," said Kathleen Brooks, research director at XTB trading group.

More broadly, Brooks said tech stocks were no longer providing market momentum.

"Without momentum helping US indices move higher, volatility could take hold, so we are not expecting stocks to move in a straight line for now, and the market correction may not be over," she said in a note to clients.

Some market watchers viewed Tuesday's strong rise in the Dow as evidence of a rotation to industrial names from tech.

Investors have been cheered by the progress on legislation on Capitol Hill to reopen the government.

On Monday night several Democratic senators broke ranks to join Republicans in a 60-40 vote passing legislation to reopen the government, which would trigger a release of US economic reports on labor, consumer prices and other key benchmarks in the coming weeks.

Tuesday's session was held on Veteran's Day, a US holiday, resulting in lower volumes than normal.

Europe's main stock markets climbed Tuesday.

London's top-tier FTSE 100 index reached a fresh record high as a weakening pound boosted multi-nationals earning in dollars, while Paris won solid gains in a day that is also a public holiday in France.

- Key figures at 2110 GMT -

New York - Dow: UP 1.2 percent at 47,927.96 (close)

New York - S&P 500: UP 0.2 percent at 6,846.61 (close)

New York - Nasdaq Composite: DOWN 0.3 percent at 23,468.30 (close)

London - FTSE 100: UP 1.2 percent at 9,899.60 (close)

Paris - CAC 40: UP 1.3 percent at 8,156.23 (close)

Frankfurt - DAX: UP 0.5 percent at 24,088.06 (close)

Tokyo - Nikkei 225: DOWN 0.1 percent at 50,842.93 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 26,696.41 (close)

Shanghai - Composite: DOWN 0.4 percent at 4,002.76 (close)

Euro/dollar: UP at $1.1588 from $1.1557 on Monday

Pound/dollar: DOWN at $1.3168 from $1.3175

Dollar/yen: DOWN at 154.10 yen from 154.15 yen

Euro/pound: UP at 87.99 pence from 87.72 pence

Brent North Sea Crude: UP 1.7 percent at $65.16 per barrel

West Texas Intermediate: UP 1.5 percent at $61.04 per barrel

burs-jmb/jgc

G.George--TFWP