RBGPF

0.1000

Most Asian stocks rose Tuesday, tracking a rally on Wall Street, after Donald Trump tempered his rhetoric against China, which he has threatened with 100 percent tariffs, while Tokyo struggled amid Japanese political turmoil.

Still, safe-haven metals continued to push higher -- helping silver join gold in touching records -- fuelled by expectations for more US interest rate cuts, worries about rising debt and warnings that an AI-stoked global rally could be overdone.

The US president sent shivers through markets Friday when he lashed out at Beijing over its curbs on rare earths, which fuelled fears he was reigniting their trade war after months of a tentative truce.

But he shifted his tone by Sunday, insisting in a social media post that "it will all be fine", and adding that he wanted to "help" China.

That was enough for traders to return to the market, with the Nasdaq soaring more than two percent and S&P 500 and Dow each up more than one percent Monday, taking a huge bite out of Friday's losses.

Asia tried to follow suit following Monday's retreat, which had been tempered by Trump's more conciliatory comments.

Hong Kong, Shanghai, Singapore, Seoul, Sydney, Taipei and Manila all rose, though Wellington and Jakarta dropped.

"Given the recent rally, positioning was stretched (and) any bad news is a cue to sell risk...which indicates the market is looking for an excuse for a selloff," said Neil Wilson of Saxo markets.

"The extent of the selling could be the cue for the last bears to throw in the towel."

Still, tech firms remain in high demand, with the latest impetus for buying coming after chip giant Broadcom formed a partnership with OpenAI to provide 10 gigawatts in computing power.

The deal came after OpenAI signed deals involving huge investments in data centres and AI chips with US companies Nvidia, AMD and Oracle, as well as with South Korea's Samsung and SK Hynix.

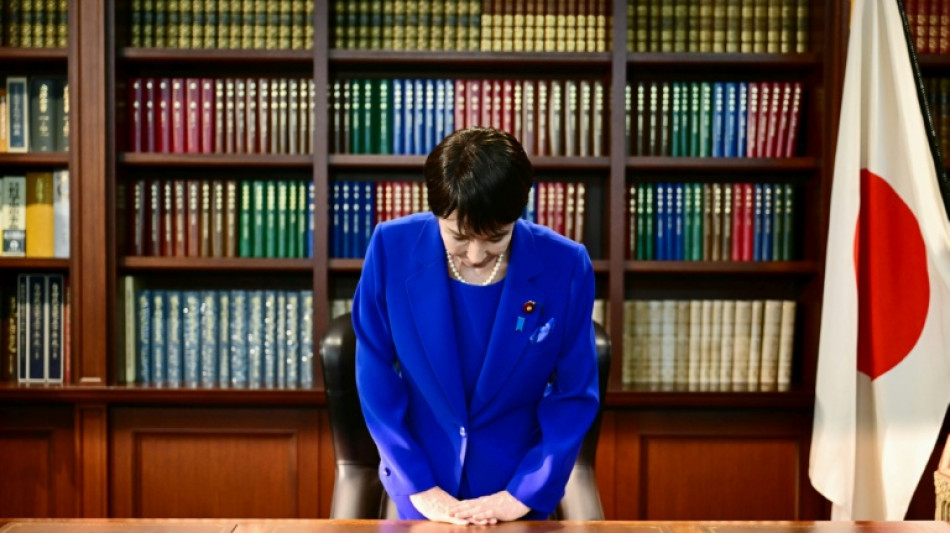

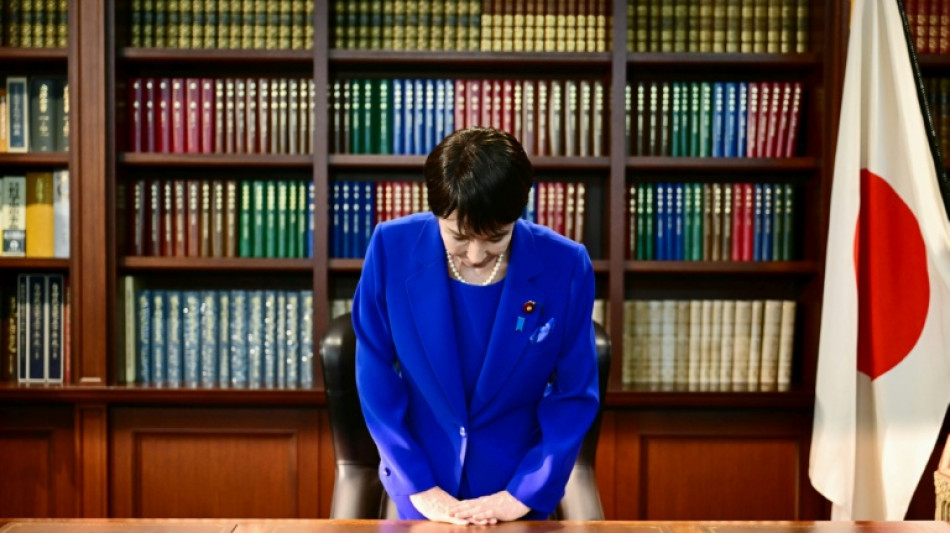

Tokyo returned from a long weekend with losses, as lingering tariff worries compound political uncertainty in Japan where the ruling coalition collapsed Friday as junior partner Komeito quit the alliance.

The move raised questions about whether Sanae Takaichi -- who became the ruling party's leader this month -- will be able to take the reins as the country's first woman prime minister.

Stocks had surged after her election on hopes she will unveil fresh stimulus measures and push for looser monetary policies.

It was reported at the weekend that Komeito will seek to support a unified candidate with other groups in a bid to block Takaichi -- who needs approval from parliament -- from becoming premier.

In commodity trade, silver struck a record $52.90 as investors sought other safe havens as gold continued to chalk up successive peaks of its own. The yellow metal hit a new high of nearly $4,150.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.2 percent at 47,520.57 (break)

Hong Kong - Hang Seng Index: UP 0.3 percent at 25,955.27

Shanghai - Composite: UP 0.5 percent at 3,910.17

Euro/dollar: UP at $1.1571 from $1.1568 on Monday

Pound/dollar: UP at $1.3343 from $1.3332

Dollar/yen: UP at 152.42 yen from 152.31 yen

Euro/pound: DOWN at 86.72 pence from 86.77 pence

West Texas Intermediate: UP 0.4 percent at $59.75 per barrel

Brent North Sea Crude: UP 0.4 percent at $63.56 per barrel

New York - Dow: UP 1.3 percent at 46,067.58 (close)

London - FTSE 100: UP 0.2 percent at 9,442.87 (close)

J.P.Cortez--TFWP