RBGPF

0.1000

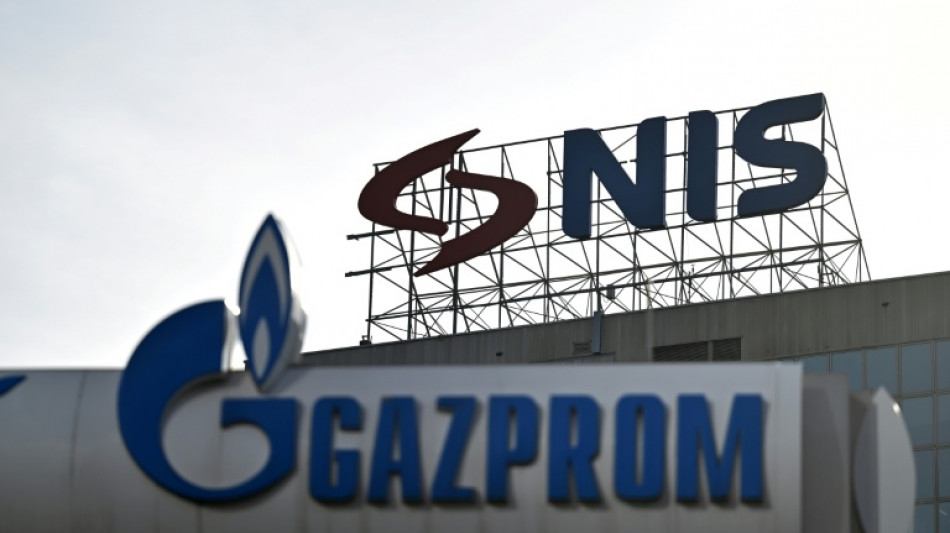

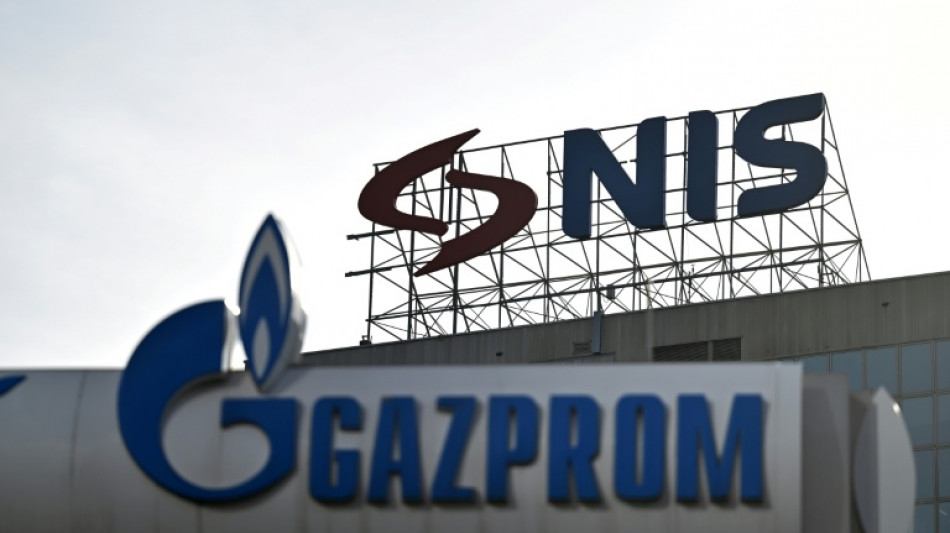

Serbia's president warned that US sanctions on the Russian-controlled operator of the Balkan nation's only oil refinery that took effect on Thursday put it in an "extremely serious" position.

The sanctions targeting Petroleum Industry of Serbia (NIS) were delayed multiple times after being first announced in January as part of its crackdown on the Russia's energy sector following Moscow's 2022 invasion of Ukraine.

President Aleksandar Vucic warned of "extremely serious consequences for our entire nation" in a television address on Thursday.

"This is bad news for our country, though expected," Vucic said hours after the sanctions took effect on the company that supplies more than 80 percent of Serbia's diesel and petrol.

Croatian pipeline operator Janaf, which supplies oil to NIS, said it would cease sending crude oil to Serbia.

But Vucic said the country had a large enough stockpile of crude oil for the refinery to operate until November 1.

Meanwhile, vehicle fuel supplies should last through the end of the year.

Vucic confirmed that talks on the company's future are ongoing with US and Russian partners.

- 'Era of jerry cans' -

NIS, in which the oil subsidiary of Russian gas giant Gazprom has a controlling stake, has warned its customers that Mastercard and Visa payment cards may stop functioning at its petrol stations due to the sanctions.

Customers may soon only be able to fill up with cards using a Serbian payment network or pay cash.

The company's central station in Belgrade was quiet on Thursday, as the head of its consumer arm told the state broadcaster there was no need for motorists to panic-buy.

"Our sales are operating as normal. There are no restrictions when it comes to the quantities customers can purchase," NIS Retail Director Bojana Radojevic said.

But Belgrade residents told AFP they were worried.

"Even if there are reserves, those reserves cannot last forever," 75-year-old Belgrade resident Rodoljub Golubovic said.

For Zoran Markovic, 48, the new measures brought back memories of the sanctions and isolation of the 1990s in war-torn Yugoslavia.

"It was the era of jerry cans and everything that went with it," he said. "It's not fair."

- Solutions -

Belgrade-based economist Goran Radosavljevic said sanctions could impact sectors ranging from finance to agriculture and affect jet fuel supply.

Energy consultant Velimir Gavrilovic said the Janaf's cutoff could mean an increase in oil transportation costs or more reliance on imported refined oil products.

A potential solution — a complete exit of Russian investors from the company — is very unlikely, Radosavljevic said.

"Russia does not want to sell its shares," Radosavljevic added, noting that although NIS represents "only a small portion of Gazprom's revenue, its political importance is huge."

But Gavrilovic suggested a "partial sale of Russian-held shares, reducing their stake in NIS to a non-controlling level," could offer a way out.

Vucic has ruled out nationalising the company, a proposal floated by some commentators.

He also rebuffed comments from Croatia's economics minister about being interested in buying the firm.

Despite Western pressure, Serbia has maintained close ties with Moscow and refused to impose sanctions, even as it pursues European Union membership.

The country remains heavily dependent on Russian gas, with its 2022 supply contract set to expire soon amid ongoing talks for a new deal.

Currently, NIS is 45 percent owned by Russia's Gazprom Neft.

Its parent company, Gazprom, transferred its remaining 11 percent stake last month to Intelligence, a St Petersburg-based firm also linked to the Russian energy giant.

The Serbian state holds nearly 30 percent, with the rest owned by minority shareholders.

T.Gilbert--TFWP